Time: 2022-05-10 Preview:

On April 29, the "2021 China Quantitative Investment White Paper" on-site seminar was held in Shenzhen. The guests gave speeches on the market situation and development of the quantitative industry in 2021. Among them, Mr. Liang Ju, general manager of Kuanbang Technology, made an in-depth interpretation of the key conclusions and data in the "White Paper", and now organizes the content of Mr. Liang Ju's speech into a draft to share with you.

01 Preface "Quantification is from invisible, invisible to incomprehensible"

Good afternoon, everyone, my name is Liang Ju, from Kuanbang Technology. I am very happy to be with you in Shenzhen today to discuss and quantify. In fact, the meeting was originally scheduled to be on the 40th floor of Futian Shangri-La, but the registration was too active. We temporarily moved the meeting to the third floor, a hall that can accommodate up to 300 people, and the venue has more than doubled.

This is also highly related to the market. The scale of private equity quantitative investment has grown from tens of billions, hundreds of billions to trillions in just a few years. The development of the quantitative industry has also experienced from the very beginning that everyone can't see it, can't see it, and can't understand it . In the market, everyone from individuals to institutions to supervision may have different understandings of quantification: for individuals, quantification is a stable income; for institutions, quantification may be a methodology to improve the efficiency and ability of research; for supervision , Does the Chinese market need quantitative investment? Does it contribute to the healthy development of the market?

The market also has some consensus: the first is complexity. Compared with some other investment methods, quantification has a lot of complexities , including technology, data and so on. The second is confidentiality , the industry transparency is not so high.

Under such circumstances, we jointly launched the "2021 China Quantitative Investment White Paper" together with Huatai Securities, Chaoyang Sustainability, Amazon Cloud Technology, and Finelite, in order to deconstruct the complexity in the middle and improve the transparency and visibility of the industry. At the same time, we also It is hoped that in this way, a communication platform can be provided to better communicate with the industry.

02 Key conclusion "The industry is gradually mature and multi-dimensional improvement"

1. After germination, growth, turbulence and maturity, there is a 35-year quantitative development time gap between China and the United States, but by 2020-2021, domestic and overseas institutions have already faced the same competition. Domestic quantification has gradually matured from the early stage of development, which is embodied in:

(1) The overall size of the market has increased, and the proportion of transaction volume has increased;

(2) The number of market entities increases and the industry concentration increases;

(3) Key capabilities have been improved, and various strategies have been quantified;

(4) Improve management refinement, from extensive to lean development.

2. With the improvement of market maturity and the intensification of industry competition, individual institutions have developed from rough development to lean development, and carried out various explorations in equity structure, investment research method, organizational structure, and investment strategy, in order to achieve better asset management scale, income , obtain a dynamic balance between stability. Especially in terms of personnel management, in addition to snatching a large number of talents, institutions also carry out better talent management through organizational structure optimization to improve the efficiency and depth of strategy research and development, as well as the flow of information between groups and strategies, so as to better stimulate innovation.

3. Affected by factors such as type and management scale, institutions have different degrees of resource control, and face different regulatory policies and investor demands. There are huge differences in quantitative market perception, investment strategies, and talent development. The market consensus believes that the current quantitative technology rankings are: foreign institutions, private equity funds, securities companies’ self-operated asset management, public funds, and bancassurance.

4. Research shows that 15.88% of quantitative investment and research personnel have an annual salary of more than one million yuan. The market adopts two salary structures: fixed salary and PnL. PnL is generally 15%-35%, and the top partner level can reach 50%. Institutions also try their best to attract and retain talents in terms of investment and research organization. Nearly 30% of institutions adopt PM+ platform hybrid investment research, that is, on the basis of large-scale and intensive development, at the same time carry out the special account fund manager system.

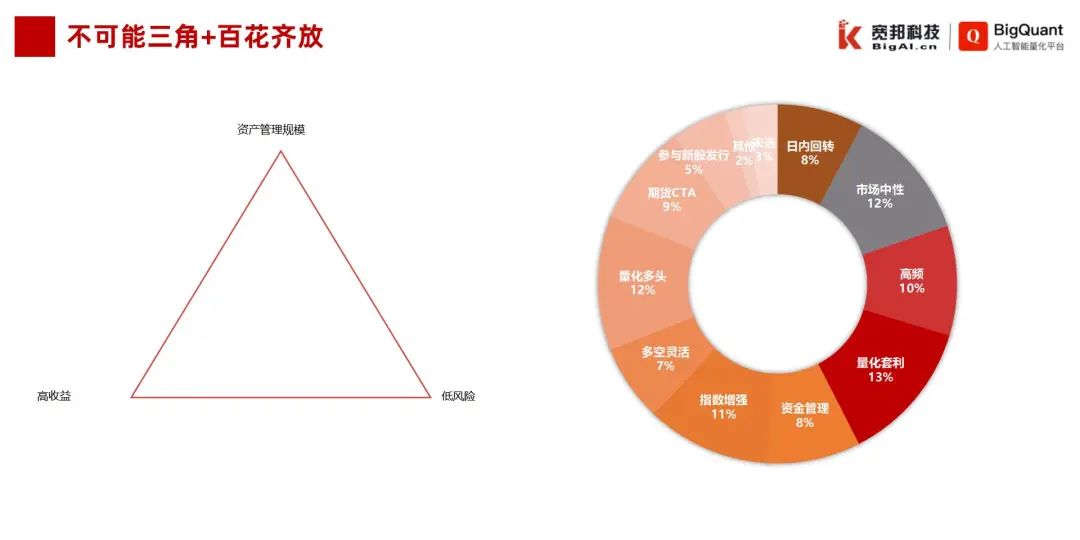

5. The strategy development path of many investment institutions is: starting with high frequency and gradually reducing frequency to form full-frequency coverage. At present, institutions generally use multiple strategies for trading, but the focus of the layout between institutions is slightly different. In general, quantitative arbitrage, index enhancement, Market neutral, quantitative long, and high-frequency strategies are currently the top five mainstream strategies. Private equity institutions pursue absolute returns, including quantitative long-term strategies, quantitative arbitrage strategies, and high-frequency strategies.

6. The Impossible Triangle of Private Equity Institutions: Scale, Income, and Risk are beginning to emerge . Including the homogeneous decline in the yields of top institutions shown in the market, the market may have reached a bottleneck period in terms of scale, and a large number of neutral products have been closed throughout the year. At the same time as the diversified development of institutional investment methods, the way of chasing income has changed from absolute to relative. At the level of investment and research strategies: artificial intelligence, high-frequency factors, and alternative data are gradually becoming mainstream in current private equity institutions, and Alpha is obtained through various methods. Public funds, insurance asset management, and bank wealth management subsidiaries are closely embracing the market beta, and fundamental quantification and fof may become a trend.

7. Eighty percent of quantitative talents believe that their professional knowledge and skills need to be improved. "The market industry/style rotates too fast, and it is difficult to quickly adjust accordingly" "It is difficult to generate ideas with Alpha, and the capital capacity is limited" "Factors: traditional factors fail, and it is difficult to form effective strategies" is the most difficult problem encountered in current investment research practice There are three major problems, but they are quite different from foreign institutions.

8. The current requirements for quantitative talents are relatively high. Domestic 985/211 and overseas QS100 masters are the basic thresholds. Skills are mainly developed through self-study + practice. Only three adults can obtain post-employment training. The urgency of knowledge and skill learning is closely related to the quantification of talent compensation, and the higher the compensation, the more urgent it is. High-paid talents pay more attention to forming leadership qualities, such as global vision, while ordinary-paid talents pay more attention to hard skills, such as artificial intelligence.

9. At present, 80% of institutions have been involved in artificial intelligence quantification. Domestic capital is mainly used for factor mining, generation and model construction, while foreign capital is more comprehensive . Institutions focus on single-point experiments and local implementation stages. 17.99% of institutions are expanding and replicating, and have the ability to complete the development and launch of AI applications, covering the entire process, accounting for 5% of the total investment. Tree model and ensemble learning are the models that are generally mastered by the market at present, and about 10% of the talents are already "very good at" neural networks and reinforcement learning.

10. Overseas alternative data is becoming more and more mature, and China is still in the blue ocean stage. Analyst sentiment and online public opinion data are the most widely used data. ESG data of listed companies has sprung up, and more than 30% of institutions have already applied it to quantitative research. More than 30% of institutions have used high-frequency factors, more than 40% of private equity institutions, 25.33% of institutions remain on the sidelines, and other institutions are gradually conducting research.

03 Talent development "25,000 employees are currently most concerned about AI"

In the final analysis, people are the core of quantitative competition , so the first focus of our industry research is on the ability structure of talents. The data survey found that from the public data, it can be estimated that there are currently more than 25,000 quantitative talents, 463 public fund managers, and private equity funds. Most institutions of fund managers are reluctant to make disclosures. The number of disclosed funds is currently 684, and 76% of the talents in the market are masters and doctors.

Quantitative institutions use social recruitment and school recruitment to attract talents. In terms of social recruitment: data shows that only 34.76% of the entire market have obtained their current jobs through open recruitment websites, and many quantitative practitioners have formed a certain fixed "circle" through a series of activities such as alumni backgrounds, Olympic competitions, strategy seminars, salon training, and market business. ”, the introduction of classmates/peers/friends and the recommendation of external industry headhunters have become a useful supplement to open recruitment.

What everyone is most concerned about is the annual salary. Salary and benefits are the primary incentive for quantified practitioners to find new job opportunities, far higher than the search for promotion opportunities or the search for technically powerful teams. Talent is the quantification of organizational productivity. A reasonable salary mechanism is Sufficient conditions for retaining and developing talents.

The current compensation structure adopted by quantitative institutions has two mechanisms: fixed compensation and PnL. The salary of quantitative practitioners is mainly concentrated in the range of 300,000 to 1 million, 15.88% of the practitioners have an annual salary of more than one million, and the annual salary of more than 2 million accounts for 2.65% . Of course, this is also closely related to the type of institution, company management scale, and urban area. Generally speaking, the salary of foreign-funded institutions is higher than that of domestic investment, and the salary of Shanghai area is higher than that of other areas. There are huge differences within private equity institutions.

In the personal ability model, artificial intelligence is one of the most concerned directions for quantitative practitioners, followed by global vision, computer foundation, innovation ability and insight analysis. The data shows that relative to hard skills, some soft skills and comprehensive qualities have gradually attracted more attention, especially in sell-side research institutions.

Innovation ability and tolerance are two qualities that are more concerned in market recruitment. In the quantitative industry, innovation ability is mainly reflected in strategy update and iteration, while tolerance is mainly reflected in being able to stay focused for a long time, researching subtleties, continuous research and development, and being able to withstand leaders or customers when the strategy has a large pullback pressure.

The financial market is changing with each passing day, and trading tools are innovating. Quantitative practitioners will encounter all kinds of temptations and challenges. Most practitioners put their focus on quantification first, followed by promotion to management positions, but there are also many factors that drive practitioners to leave their original institutions. The main reasons are: remuneration, promotion opportunities, and cultural inclusiveness.

From the perspective of human resources, the data shows that professional knowledge and skills still need to be improved, which is the most common problem encountered by current quantitative practitioners, accounting for more than 80%. Because quantification is generally a very comprehensive ability requirement, it is necessary to be able to write code, understand finance, and be able to operate and maintain servers.

Secondly, the staffing is not enough, the work content is relatively scattered, and there is no full-time work (43.32%). From data to factor mining to modeling, many of them need to be done by the practitioners themselves, so there is a lot of fragmented time. Work. There are also many institutions developing in the direction of platform, allowing talents to focus on some aspects of their own specialization.

At the specific investment and research level, market style rotation is too fast, factors are invalid, and strategies are difficult to generate. These are the three most difficult problems encountered by quantitative practitioners . Foreign investment may represent the difficulties that quantified practitioners will face in the next stage. The current ranking of foreign investment is: a lot of daily work lies in duplicating codes, and fewer ideas are generated; market industry styles are rotated too fast.

Just now, I heard two colleagues talking next to me saying, "Factors are already quite crowded, and you may have dug up the same amount of regular factors. Is there any other way to find some new factors? Does it come from people? The brain still comes from the machine, in fact, everyone is thinking of various methods. ” Some people describe quantification as mining, which requires a lot of computing power to calculate and solve very complex problems, and the efficiency of solving itself is also very important, so many institutions began to They have also made a lot of investment in computing power, and even spent tens of millions of dollars to build their own computing power center. In addition to computing power, an environment is also needed. Efficient environment construction helps internal teams to achieve smoother processing from the entire process of strategy research. In general, organizations face many challenges, and of course new solutions are being developed to address them.

04 Institutional practice Hundred flowers bloom and the impossible triangle is encountered for the first time

Taking history as a mirror, we can see the ups and downs. Looking back at the quantitative development of the Chinese and American industries, the first quantitative funds appeared in the United States in 1969 and China in 2004. There is a 35-year time gap in the development of the industry. By 2020-2021, domestic and overseas institutions have already faced the same field. sports. Just now we talked about institutional changes in the process. The first is the increase in the overall size of the market and the increase in the proportion of transaction volume; the second is the increase in market entities and the increase in industry concentration; the third is the improvement of key capabilities and the blossoming of various quantitative strategies. The fourth is to improve management refinement, from extensive to lean development.

During this period, we found that the market’s definition of quantification is not clear. One institution told us that although they started with quantification, they now mainly do large-scale arbitrage, which is not quantitative. At the same time, we can also see various data. Agencies define various types of policies so vaguely that data varies widely.

This time, we mainly classify according to the "Quantitative Private Equity Fund Operation Report" required by the Securities Fund Industry Association of China to be submitted by private equity funds in 2021. The survey data shows that the current institutions are mainly multi-strategy. Sexuality, index enhancement, quantitative long, and high-frequency strategies are currently the top five mainstream strategies.

In this, private equity pursues absolute alpha, and will mostly use quantitative long-term strategies, quantitative arbitrage strategies, and high-frequency strategies. Most of the public funds choose quantitative long-term strategies, index-enhanced strategies, and market-neutral strategies.

From the perspective of income, the data of Guotai Junan Asset Custody Department shows that in 2021, the performance of leading institutions in various quantitative strategies will not be as good as that of shoulder institutions. The shoulder mechanism can reach 19.61%.

This is mainly because the leading institutions are encountering the impossible triangle for the first time, and it is difficult to achieve a balance between scale, income and volatility .

Factors are one of the core secrets of quantitative institutions. Nearly a quarter of the respondents refused to disclose the number of factors currently stored by the institution and chose to skip this question. Among the respondents who answered this question, more than half of the institutional factors are controlled within 500, and 6.52% of the institutions have stored more than 10,000 massive factors, 30% of the commonly used factors are within 10, and 37.97% of the commonly used factors are in 50 or less . As can be seen from the figure on the left, the overall features are high at both ends and low in the middle, reflecting two styles of the market. Some institutions select deep mining factors, while some institutions use machine learning to mine massive factors, but when they actually land, At present, it is seen that the last commonly used factors of these two methods are still less than 50, and after the massive factors are excavated, they will also be optimized.

The way of talent organization affects the way, quality and efficiency of talent collaboration. At present, institutions generally use the Silo System silo type, that is, the PM mode, the Centralized Book platform type and the hybrid type to cooperate.

The "silo type" can also be called the PM model. The fund manager leads the team to be responsible for setting up the environment, data cleaning, factor research, development strategy, backtesting, model modification, and also serves as an analyst, developer and trader. It is characterized by PM as the core, forming different small circles within the organization.

"Platform type" can also be called pipeline type, which is characterized by process-driven, data engineers do a lot of data research to build new data on the platform, researchers mine new factors and build strategies on top of the data, and investment managers build products and services Users, and ultimately form the company's products.

"Hybrid" mixes silo and platform, but is not a transitional stage between the two. After many companies have formed a stable platform, in order to attract more outstanding talents with independent strategy development ability, the form of investment and research organization formed naturally. In the original company, the investment and research system has been improved, employees have grown, external fundraising, and employee income have been beneficially supplemented.

The current survey data shows that more than 40% of the institutions use the silo type, 20% of the institutions use the platform type, and nearly 30% of the institutions use the hybrid investment and research organization. In terms of sub-categories, small and medium-sized institutions prefer the silo-type organizational structure, and a higher proportion of large-scale institutional teams adopt the platform type to achieve the purpose of intensive development.

05 Frontiers of trends: from human summary to machine becoming assistant

Everyone will pay attention to the future. I just said that the 1 trillion-scale market has begun to show a bottleneck. What will we do in the future? Our survey found that the application of artificial intelligence, fundamental quantification, high-frequency data and high-frequency factors are the three directions that the market is most concerned about. We studied the official websites and talent recruitment structures of the top 30 private equity institutions and found that by 2021, 29 of the top 30 private equity quantitative institutions with 10 billion yuan are already deploying artificial intelligence.

This is also in line with our research data. In traditional quantitative institutions, people rely on rules and theories to make models, while AI is based on a large amount of data. Machines can mine larger-scale data and form a non-linear structure. The survey data shows that currently 8 Cheng and above have begun to try artificial intelligence quantification, which is mainly used in the factor and model stage. Among them, 62.57% of the institutions are used for factor generation, and 56.15% are used for model construction. This may be because the model has an upper ceiling, and the effect of factor mining is immediate. Factor mining has changed from relying on people to summarize methods, to people looking for machines as assistants, looking for some effective and inspiring things, and finding new ideas, and then people build on top of machines to enhance transparency and interpretation. sex. In terms of model construction, it used to be linear, but now it uses deep learning or more complex structures to mine some deeper end-to-end models.

Transaction execution and risk management applications are relatively small. In terms of institutional classification, the use of foreign-funded institutions is more comprehensive. Except for transaction execution, the utilization rate of each link is above 50%. Especially in asset portfolio management, transaction execution and risk management, it greatly exceeds that of domestic institutions.

Artificial intelligence is not only reflected in the algorithm level, but the technology itself is a systematic project. The questionnaire surveyed the AI maturity of the organization. The organization is making various investments in terms of strategy, technology accumulation, algorithm, computing power, and manpower. The data shows that the organization In the stage of centralized and single-point experiments and local implementation, 11.11% of the institutions have already implemented large-scale implementation, and the large-scale implementation of AI scenarios is > 10, accounting for 30% of the total investment, but some institutions have not yet achieved end-to-end one-off sexual coverage. There are some specific data in the white paper, which we will not discuss here for the time being.

The specific algorithm level is also scored on a scale of 1-7, 1 is no research, 7 is very good, quantitative practitioners from the shallower to the deeper, using the most familiar machine learning/artificial intelligence quantitative models are tree models, integrated learning, about 30% have been Fully proficient application. Although the application of neural networks and reinforcement learning is not high enough, this may be due to the high start, slow start, too many details, and high dependence on the amount of data.

Kuanbang has also made many basic models in the past year, such as stockranker, deep alpha, etc., but in fact, the application in the organization is more rich and complex.

In 2019, the JPMorgan research report specially sorted out the actual combat of overseas alternative data and various sources, and divided all alternative data into three categories: personal activities, company business, and sensor data. There are nearly 1,000 manufacturers, and the sensor data includes agricultural satellites. , maritime satellites, financial mining satellites, parking lot satellites, energy satellite images, etc., forming a very complex system.

As an investment application, domestic alternative data started later, and it is far from the mature market application overseas. It is currently in the blue ocean period, and the market has not yet formed a unified understanding. Some participants believe that alternative data is called alternative data because of its limited use. On the one hand, the current alternative data vendors are relatively small in size and relatively scattered, and institutional procurement verification is troublesome. On the other hand, unstructured data is difficult to clean, and it is difficult for institutions to use and verify.

The data of this questionnaire survey shows that currently 20% of the institutions have used alternative data, and 40% of the institutions are conducting active research. In terms of sub-categories, analyst sentiment indicators and online public opinion indicators are the most used/researched, while ESG data has only just emerged, but it has also received a lot of attention.

After the stock market crash in 2015, stock index futures suffered a severe discount, and the neutral strategy encountered a cold winter. Some quantitative institutions turned to index enhancement, and some institutions turned to high-frequency strategies based on volume and price. After 2019, a large number of high-frequency strategy products entered the market.

High-frequency research used to be speed-oriented, hoping to minimize delays. Generally speaking, institutions do not disclose the speed of high-frequency trading. On the one hand, the transaction speed directly affects the performance of the strategy. On the other hand, the transaction link and speed calculation are more complicated. The factors affecting the speed mainly include: software/hardware, deployment method, machine learning/non-machine learning, transaction target, etc. The peak transaction speed can reach about 800 nanoseconds.

In addition to arbitrage, the market is talking about "high frequency" scenarios, and there is another scenario where the market processes Level 2\3 high-frequency market data as high-frequency factors, including minute K-line, order queue, market snapshot, and order by order. , transaction by transaction, etc., in order to more deeply describe the willingness of investors, generate better Alpha than ordinary factors, and increase the amount of data to combat the overfitting of artificial intelligence.

The questionnaire survey shows that 30% of institutions currently use high-frequency factors, and nearly 35% of institutions maintain active research. 83% of sell-side institutions maintain research, and private equity funds use the most, reaching 36.87%, and institutions below 100 million use less. Only 14.29%. It is also highly correlated with the salary of quantitative practitioners, and the higher the salary, the easier it is to use/research high-frequency factors.

The above contents are the key conclusions and data that Mr. Liang Ju shared with you at the scene. At the same time, Mr. Liang Ju hopes that he can continue to explore and research together with everyone in the future, including the quantitative white papers in 2022 and 2023, so that more partners can participate and make the quantitative industry better.

If you want to know the complete content of the "White Paper", you can scan the QR code below, add the [Finelite] customer service WeChat account, and receive the electronic version!