Time: 2022-08-17 Preview:

"On April 29, the "2021 China Quantitative Investment White Paper" jointly organized by Huatai Securities, Kuanbang Technology, Amazon Cloud Technology, Chaoyang Sustainability, Finelite and other market authorities was officially released, and a press conference was held in Shenzhen. Zhang Xiaoquan, founder of the Super Quantum Fund, attended the meeting and gave a speech entitled "The Future of Quantification: Understanding and Coping with Uncertainty", and we recorded the text for readers."

Thanks to the organizers today, I also bring you some dry goods today, which are some underlying logic issues that our own team often thinks about.

01

Just now, basically every speaker mentioned the involution of quantification. Where is the future of quantification?

Let me tell you a story first. In the 1940s of World War II, Germany developed the encryption cipher of the Enigma machine. Because of the complexity of the encryption method of the cipher machine and the timeliness of intelligence, theoretically there is only 24 hours to crack each password. If If one day is not completely cracked, the next day the password is changed and you have to start over.

So the United Kingdom found a lot of people who broke the secret, and Turing said a word: "I don't want to do brute force cracking, I hope to develop something with the underlying logic, in this case, I can get any password and information in time. crack."

Turing proposed a new methodology from a mathematical point of view, and used a method of logical calculation to calculate the underlying logic, and finally achieved great success.

Stories trigger our imaginations about the future of quantification.

Quantization 1.0, Fama-French three-factor linear model.

Quantization 2.0, machine learning nonlinear relationships.

Quantitative 3.0, we think it is a combination of mathematical statistics + machine learning + economic and financial models.

This diagram explains why the two are combined, because their goals are different. The goal of economic and financial models is to explain, to clarify the underlying logic. Machine learning is violence, I don't need to know the underlying logic, just make predictions. Mathematical statistics is a better description of data, and all three are indispensable.

As follows, the vertical axis is the predictive ability, and traditional machine learning will hope to push the predictive ability upward. The horizontal axis is economic and financial theory, hoping to explain the phenomenon and clarify the underlying logic. Predictions and explanations sometimes contradict. For example, geocentric theory has strong predictive ability, but poor explanatory ability. It can predict that the sun will rise in the east and set in the west, but its explanatory power and underlying logic are wrong. The evolution theory has strong explanatory power, but poor predictive power. The theory of evolution can explain why humans have evolved from monkeys to the present, but it is difficult to predict what humans will look like in the future. In the future of quantification, our deductions are not enough, and we have not achieved the ultimate.

02

Today I will share with you our super-quantum investment and research system and our underlying philosophy.

At the top of the pyramid is the asset management business. It is very simple. Any private equity in risk control, trading, and asset management will have it.

The second layer is also common to quantitative private placement, financial engineering, machine learning, models, factors, and strategies.

There are two further layers below, all of which Super Quantum strives to improve. The first layer is Science, mathematics, modeling, and statistical tools. Among them, statistical tools are used to develop new statistical models from the bottom to gain a deeper understanding of the underlying financial data, thereby eliminating overfitting and generating causal relationships. Model.

On the next level, there is also the part of art, which is the understanding of uncertainty, thinking about value, insight into human nature, and the pursuit of elegance.

03

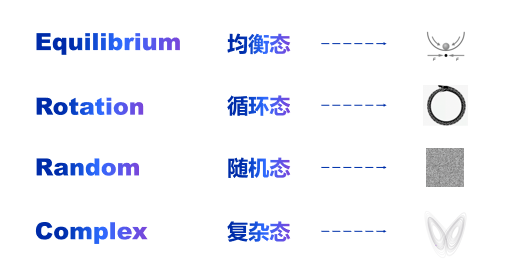

We believe that everyone's view of the world can be decomposed into many small logics. The world has four states: equilibrium state, cyclic state, random state, and complex state.

The equilibrium state is that the ball is placed in the bowl, and when pushed, it will return to the bottom of the bowl.

The cyclic state is that no matter how things go around, they will come back later. For example, the economy has cycles.

Random state is also a state that cannot be predicted, but it will generate random data.

The complex state is like the butterfly effect, a small perturbation can lead to a very different final outcome.

These four states exist in the financial market. Our goal is to find a way to disassemble them and understand these states from the bottom.

For example, if the height of a person is described by a normal distribution, it will be described more accurately. If a power-law distribution is used, the conclusion is easy to be wrong. So the model is dead, and the most important thing is what kind of logical method those of us should use to describe this data.

The same is true for stock data, with sharp peaks and thick tails, but most of the models we use now are based on normal distribution. Can we jump out of the normal distribution to find a new bottom layer and understand financial data from a scientific level?

04

Probability distributions often do not exist in fact, and many people do not understand uncertainty deeply enough, thinking that uncertainty is volatility, and when volatility is high, uncertainty will come up, but this is not the case.

Laplace said in 1814 that probability distribution does not exist in many scenarios, such as war, election, research and development, marriage, investment...

How to count these probabilities, Laplace believes that when the probability of a certain event is not known, all the probabilities are considered equal, which is obviously wrong, because if the normal distribution is used, there is still some information, and if the uniform distribution is used, there is no information. , it is difficult to make statistical inferences.

So how many levels of uncertainty are there?

The certainty is that if I randomly grab a small ball from here, it must be yellow, just as the sun rises in the east and sets in the west is certain.

The risk is that there is a 70% probability that the stock market will rise tomorrow, 30% may fall, and 30% will fall is my risk?

A black swan means that there may be a very small probability that it will produce results that I didn't think of before.

The fourth is uncertainty other than risk, but there are currently no statistical and mathematical tools to measure it, just like I know the stock market will rise or fall tomorrow, but I don't know the probability distribution.

Which of the above four risks is closer to the description of the real stock market?

The mainstream financial models now use the second model, but it is actually the fourth one. We don’t know the distribution, and we need mathematical tools to solve it.

05

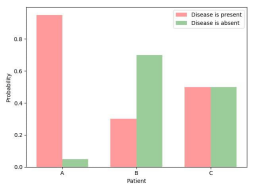

Results uncertainty and distribution uncertainty must be distinguished, so if you use traditional models to analyze very complex financial markets, there may be large deviations.

Risk and uncertainty are two concepts. For another example, the three patients of ABC have an infection probability of 95%, 30% and 50% respectively.

Who is at the highest risk? patient A.

Who is most uncertain, patient C, because we have no information about him.

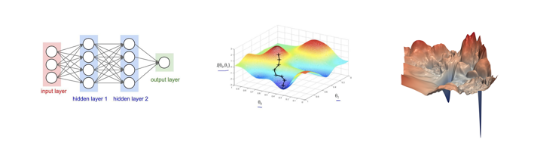

The limitation of traditional machine learning is that you use a neural network to minimize the loss function, find the optimal solution, and find the lowest point. However, the loss function of the financial market may be the third one below, starting from the starting point and optimizing for half a day, and cannot find the lowest point. So where is the problem? The problem is that the shape of the loss function is very complex, and the uncertainty in it makes it impossible to find the optimal solution with the traditional model.

We relaxed the assumption of independent and identical distribution, and made a lot of derivations based on the assumption of independent and different distribution. The conclusion is that what the traditional model thinks will happen with a 95% probability, plus a little uncertainty other than the risk mentioned earlier , the confidence has dropped from 95% to 60%. If you trade with 95% confidence, you will take a lot of risk. So when we understand uncertainty more deeply, the behavior of trading will change accordingly.

The same is true for the thick tail of the black swan. The thick tail is traditionally analyzed by the fourth order of Kurtosis, and the tail thickness of 3 is a normal distribution.

When there is no distribution uncertainty in the market, the tail that is not a normal distribution is obtained. Once there is a little uncertainty, Kurtosis is found to grow rapidly, so the thickness of its tail immediately increases a lot. model is no longer available.

06

So I just talked about mathematics for a long time, not to confuse everyone that mathematics is very complicated. For example, what can mathematics do?

On January 19, 2020, I wrote a public account "Want to be happy in 2020? Go short the US stocks", there are two conclusions: 1. Those who have US stocks can lighten their positions and avoid them; 2. Those who want to take risks can go short. Everyone knows that the U.S. stock market crashed at the end of February. Buffett also said: "Who has made money by shorting the United States in the past 238 years?" Our team laughed. We did make money by shorting the United States in 2020.

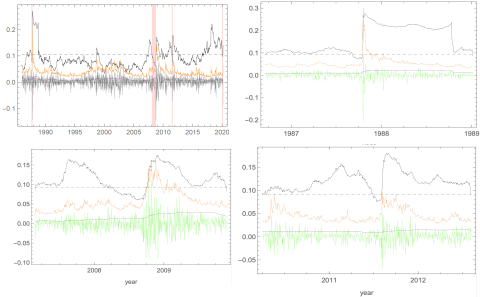

The black line in the figure below is our index. The signal is that when it falls rapidly from the high point and exceeds the threshold horizontal dotted line, there will be a signal. From the signal to the real stock market crash, it is the red line.

In the past 30 years, the stock market crashes in 1987, 2008, 2011, and 2020 have all given very accurate signals. For example, in 1987, the stock market crash occurred within one month after it quickly crossed the critical line. Similarly in 2011, the threshold was exceeded on January 8th, so we short-sold the TVIX index, from 39 yuan to 1,000 yuan within a month, achieving a return of about 25 times for a single strategy. At the same time, he bought a short option at a price of $0.25, which eventually rose to $25, realizing 100 times of a single strategy.

07

We not only look at the conclusion, but also at the logic of the conclusion.

Even monkeys in the stock market have a 50% winning rate. If an institution has a high winning rate in the past month, it does not necessarily mean that the individual is strong and the underlying logic is correct. So we will discuss a lot of similar questions internally: Is your logic right? A stopped clock is always right twice a day, so even if the strategy is wrong, it is possible to beat the market from a pure probability perspective, but if you want to beat the market for a long time, the underlying logic must be right, not a temporary conclusion Correct, this is the first point.

The second point of view, we believe that the financial market is like the ecology of the ocean, and different investors are different fish, but from an ecological point of view, it is impossible for sharks to eat up all the small fish, and no strategy can fully harvest, But strong sharks can leave weak sharks with no food to eat and die . Therefore, in the case of the same strategy, it may lead to a very competitive situation.

What does the future of quantification look like? We believe that it is a very early stage of quantification. All institutions are not fish, but paramecia. Why do people think the strategies are very convoluted and similar? It is because it is in the early stage of evolution. Everyone uses the same strategy and eats the same fish. So I feel that the competition is fierce, and the industry is involute. In the future, every quantitative institution must have its own methodology for survival like our super quantum fund. Then each institution will become a different fish, forming a complete financial ecology. In the process of evolution, our fund wants to rely on The purpose is to develop a new investment research model with mathematical methods based on a deep understanding of the financial market.

If you want to get the "White Paper", you can scan the QR code below, add the [Finelite] customer service WeChat account, and get the electronic version!