Time: 2022-05-24 Preview:

A period of Ruitian's development history is a profile of the rise of domestic quantitative private equity.

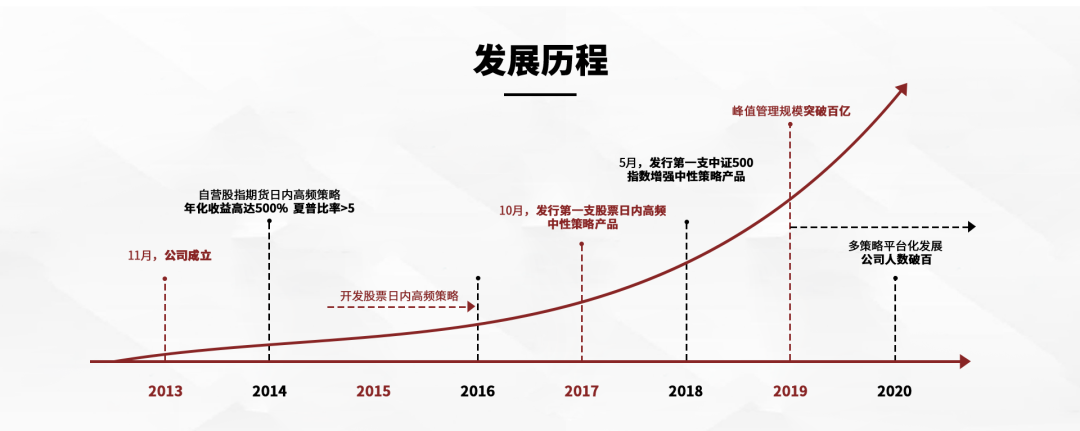

In 2010, China had stock index futures varieties, and the first generation of quantitative investors returned to China from the United States. By 2015, the first round of the feast was over, and stock index futures changed from premium to discount. In the future, Ruitian Investment, known as one of the "Four Kings of Quantification", was established during this period.

Re-reading the introduction of Rui Tian's official website, there is no deep meaning: "Rui Tian is a high-tech company driven by data. We have always focused on quantification, have a rigorous scientific attitude, and have a passion for investment research. Rui Tian hopes to transform It will leave its own mark on China's financial history."

01 "I also wondered whether quantification would exist in China"

Xu Xiaobo, in high school, won the first place in the finals of the National Physics Competition for Middle School Students, and has a double degree in physics and economics from Peking University. In 2012, he worked for Citadel, a well-known US hedge fund, engaged in the development and research of quantitative trading strategies. The single-day US stock trading volume of his team reached 10 billion US dollars, contributing a large amount of trading volume.

In 2013, Xu Xiaobo discovered by chance and coincidence that the domestic changes had quietly occurred. Some giants began to deploy in China one after another. He cleverly seized this opportunity, recruited high school classmates, and completed a strategy system from 0 to 1 in a small private house. Build, establish Ruitian.

Xu Xiaobo attributed the development to the opportunities of the times and the opportunities given by the market. In 2014, the annualized return of Ruitian's proprietary stock index futures intraday high-frequency strategy was as high as 500%, and the Sharpe ratio was >5. "At that time, high-frequency programmatic access was also a new thing for securities companies. We were the first institution for many securities companies to access, which was regarded as a precedent for the quantitative industry. At that stage, everyone knows that it was originally in China. Under the stock T+1 system, high-frequency can achieve such a scale. Of course, there will be many small drawdowns during this period. I remember that a new set of strategies was last tested, and the backtest was very good. The sky ran very well. At that time, I was relatively lacking in real market experience and risk control experience, so when the market suddenly changed suddenly, it was difficult to grasp. And the perception of risk itself is still very impressive today.”

There is not much time left for Ruitian to grow. After 2 years of establishment, the market changed suddenly in 2015. At the end of May, A-shares experienced a deep adjustment caused by "investment checking and leverage reduction", and fell sharply. , the Shanghai Composite Index bottomed from a high of 5178 points to 2850 points, a drop of 44.96%.

During this period, in order to curb excessive speculation and strengthen the supervision of abnormal transactions, the CFFEX made successive moves on August 25, August 28, and September 2, limiting the opening trading volume to 10 lots at one time. The margin standard for hedging positions has been raised to 40%, and the handling fee for closing positions within the day has been raised to 23/10,000. After the implementation of the strictest control measures in history, the trading volume of the three major stock index futures has shrunk significantly and has been maintained at the level, and the operations of futures companies have been affected to varying degrees.

At that time, when Rui Tian was ready to expand his territory with high fighting spirit, the cold water poured down. "Stock index futures stopped suddenly, and programmatic access was limited. I was particularly impressed. At that time, we had already accumulated funds and were preparing to build a team and plan to build a stock system. The discount of stock index futures exceeded 30%, one per day. One account of the product only opened 10 lots, and I once doubted whether the quantitative industry would still exist in China. The quantitative industry has not been cleared, and we are lucky to be alive today.” Looking back, Xu Xiaobo downplayed that Ruitian released the first pure T0 Intraday high-frequency neutral strategy products for stocks, in 2019, the scale exceeded 10 billion yuan. Xu Xiaobo became the youngest head of tens of billions of quantitative private equity in China. Today, he has led the Ruitian super 100-person team to continue to develop.

02 The market is impermanent, looking for outbreaks in stability

History becomes stories, stories become legends. By 2021, the market structure has changed, the scale of quantitative private equity has reached one trillion, and more than 30 institutions have entered the ten billion private equity quantitative club, but they have also experienced many pullback tests. "The darkest moment is a time of rapid development, because everyone will continue to innovate and make products with higher returns, which will form market competition pressure. The market is undergoing very rapid changes, superimposed on the outbreak of the epidemic, the game between China and the United States, the global water release, and the capital market. The continuous acceleration of a series of events such as opening up. Before the bubble burst, where is the market now? No one knows." What Xu Xiaobo saw is that the quantified returns and the market's returns are more and more overlapping. "The market changes and uncertainty are increasing, and Ruitian still chooses a stable risk control system." During the market downturn in the past six months, the steady performance against the trend has confirmed Ruitian's judgment and depth of understanding of market risks. "The market will always surprise or frighten you. You never know what you will face tomorrow. The volatility of the market variance is always there, ups and downs, and profits and losses are the same."

Having worked in the industry for many years, Xu Xiaobo is slowly adapting to this uncertainty, and condensed his investment philosophy into one sentence: looking for market outbreaks while maintaining stability. "It is impossible for us to achieve the top market returns in any investment cycle forever. This is unrealistic. Of course, there may be companies that can do this, but I think Ruitian still needs to work hard to get close. Our goal It is enough to be stable enough in many cases. When some big market opportunities come, we can seize them. For example, in 2015 and 2018, some stages are not particularly explosive, but at least they are profitable. Of course, we also I'm eager to seize some big market opportunities, but we can't seize every wave." Manpower will eventually be exhausted, and it is difficult for a company to clearly grasp every wave of market conditions.

Therefore, Xu Xiaobo does not fully agree with the opinion of some market participants that the structure of quantitative institutions is initially determined. "Let's see when this wave of retracement ends." Xu Xiaobo believes that quantification itself is the use of computer and mathematical statistics to find some opportunities in financial asset pricing, so there are very high requirements for data processing and information mining, and the requirements themselves It is also evolving, so a big difference between quantitative and active trading is that the strategy needs to be updated and iterated continuously to further meet the expectations of the market, including changes in the competitive environment will have a great impact on the entire strategy framework, and This is why Ruitian pays attention to technology.

Rare in the industry, Ruitian has specially put a multi-level and multi-angle risk control system on the official website, and at the same time incorporates risks into a comprehensive and systematic management process, and divides all risks into strategic risks, transaction risks, consistency risks, There are four parts of operational risk, which conduct research on factor portfolio, investment research, macro policy, operational compliance, market transactions, and strategy iteration.

"From a long-term perspective, the most important thing in investment is to 'control the drawdown'. If the drawdown is not well controlled, even if the early stage of the floating profit is solid, once the heavy volume falls or the market fluctuates, investors will face a long waiting period. At the same time, risk control is not only a data level, but also a consciousness level. I think it is the construction of the system."

When did you feel like a mature quantitative investor? "When you know that you are immature, you are mature." Xu Xiaobo said, "In the face of a sharp pullback, it is difficult for anyone to maintain a stable attitude. Quantitative investors need to get along and coexist with this market, and constantly experience the test and temper of the market. , which is a process of continuous adaptation.

03 Diversified development makes each track deeper and more solid

Subjective pursuit of art, quantitative pursuit of science, in Xu Xiaobo's view, the two are two different ways of thinking methodologies. Quantification is more a strategy of obtaining alpha strategies or market forecasting capabilities through large-scale systematic mining of the inherent laws of data, and using these forecasting capabilities to conduct trading games in the market. Subjective fund managers are more subjective summaries of data and make judgments on asset prices. These judgments are based on many high-dimensional unstructured information, including communication with listed companies, judgments on industries, industry development stages, companies The understanding of the governance structure, how the capital market itself views the company, etc. make judgments. These are the ability to make high-dimensional information judgment decisions based on a few data points, and then to mine the market and trade.

The essential difference between these two methods is also the methodological difference between the process of human beings as an intelligent biological decision-making process and the modern so-called artificial intelligence. After years of evolution, people have formed social knowledge, including industry knowledge, including judgments about people's society, but the machine itself uses some structured data and a lot of training to optimize the function to obtain the so-called continuous approximation optimization results. Therefore, these two methodologies are essentially a competition between humans and machines. Although artificial intelligence is constantly developing in order to achieve a more Homo sapiens state, there is still a big gap between artificial intelligence and human decision-making ability so far. But in the future, regardless of quantitative or subjective investment, the two will be integrated from various perspectives such as trading, risk control, and alternative data. For example, he said: "Many large subjective hedge funds in the United States will also use algorithmic trading to provide some execution optimization after the strategy generates positions; or high-leverage operations have very high requirements for risk control, fund managers will also use quantitative By means of optimizing the investment portfolio, controlling the drawdown, and continuously optimizing the return-to-return ratio; or by continuously mining more alternative data like quantification, such as the number of downloads of game companies in the App Store, the number of oil field trucks entering and leaving, and so on.”

Remain in awe of the market, accept changes in the market head-on, and pursue meticulous algorithms. In the next step, Ruitian hopes to deepen the efficient operation and operation of information for each team under the original "multi-team system, multi-channel and multi-strategy". Refinement management. There is a wall between high frequency and low frequency, but Xu Xiaobo still hopes to stimulate the communication between various strategy teams. Through experience, case sharing or solutions in specific fields, it is transformed into solutions in other fields, and "making each track deeper and more solid" is Xu Xiaobo's attitude towards Ruitian's development.

Xu Xiaobo did not shy away from saying that facing the challenges of constantly failing strategies and extremely fast and crazy markets, it is a daily routine to think about and implement and improve the strategy system. Competition is intensifying, but new laws are constantly emerging in the market. In his view, industry involution is essentially homogeneous competition. Everyone is doing the same thing. China has a large population base and a large market, and involution is difficult to avoid. . As for any frequency band with profit opportunities, in fact, everyone will study it. It is difficult to say what is the fundamental difference between everyone in terms of the big framework and the big methodology, because everyone is watching these transactions at the same time, mining the rules, and the same data, so the source is the same. Yes, the competitive fields are all similar.

But from another point of view, the Alpha of any asset has a relatively large volume, and it is difficult for one company to monopolize the entire market, so in general, in terms of the methodology of many details or the method of some factor mining iterations, in fact, each company is still There are some differences, but the differences are in the details. "So we need to position ourselves. Each strategy system still has its own innovations and seeks to differentiate. But seeking truth from facts, there is no holy grail in the market, and the ups and downs have to go with the flow."

04 Market supply and demand contain quantitative opportunities

From the earliest high-frequency trading background, Rui Tian now has multi-asset, multi-cycle, global market strategy coverage. Through continuous dispersion and continuous optimization of each sub-strategy, it has achieved long-term competitiveness. Xu Xiaobo believes that Ruitian’s goal is to continuously diversify in terms of strategic asset classes, asset richness, and asset cycles, and to continuously evolve and progress on various tracks, so as to adapt to various asset cycles and a strategy system rich in value fluctuations, and ultimately Across the market, across the changes in the competitive landscape, and across institutional changes.

After years of development, Ruitian has formed a number of product lines such as Panshi, Zhizeng, CTA, and special accounts. Among them, Panshi neutral products, as the core products of Ruitian, will rely on the dazzling excess of 300 strategies in 2021 to promote the trend of leading the market neutral strategy from 500 neutral IC hedging to 300 neutral IF hedging to respond to market bulls Bear, style switch. The index enhancement series mainly helps customers enjoy index dividends and gain stable excess, covering 300/500/1000 and MSCI index increase line. The CTA product has been built since 2019, covering all commodity asset categories. The construction of three sub-strategies of CTA, stock index and subjective has been completed. The technology-based Ruitian is also extending to the macro and fundamentals, and the commodity strategy line is growing. It is another major strategy in addition to stock assets.

In addition, the special account is mainly based on stocks and commodities, supplemented by alternative strategies such as convertible bonds and options. It is precisely customized for investors who can meet various risk preferences and has the characteristics of high flexibility.

Xu Xiaobo tried to find China's quantitative development from the quantitative development path of the United States. "This trend is more and more similar to the United States. Whether it is the talent pool, the iterative method of the model, the framework of the transaction, or even the method of machine learning, the future of China and the United States is very similar. So this is also necessary. We learn from overseas experience, absorb excellent overseas hedge fund talents to return to China, take root in the Chinese capital market, and develop our own value in the Chinese market."

In his view, when the quantitative market just started to open in the past two years, it was normal to have a gap. After all, the US has also reached a certain level of volume competition. Now the gap is actually difficult to define, and it is more reflected in the understanding and cognition of the market. methodologically, but standing at this point in time, I believe that the differences in the system are beginning to shrink. It has not been two or three days for overseas institutions to deploy in China, and they have been trading in the past few years, but it is difficult to say that they will absolutely crush domestic institutions. The market competition will become more and more fierce, but the local power is still not to be underestimated.

The industry leader is Xu Xiaobo's goal for Ruitian Investment since its establishment. In his view, there will be 10 trillion yuan of non-standard funds in the market that will turn to standardized allocation in the future, and there will be a large gap between market supply and demand. There is no doubt that high-quality assets with better risk control are quantitative investment products. If calculated based on the growth rate of 5 times in three years, there is still a supply and demand gap of 7.5 trillion yuan in the quantitative investment market. This is a huge opportunity. Quantitative investment in the next few years The market demand is far greater than the supply. At present, the fund chooses the manager, and in the future, it will become the manager choosing the fund. With its own characteristics of spanning cycles and stable long-term profits, quantitative strategies will usher in huge development opportunities.”

If you want to get the "White Paper", you can scan the QR code below, add [Finelite] customer service WeChat account, and get the electronic version!