Time: 2022-07-12 Preview:

The first half of 2022 officially ends! The major lists of the quantitative private equity industry are competing to be released!

Looking back on the development in the past six months, the ranking of quantitative private equity returns and the ranking of various strategies have changed to varying degrees.

Then, as an important factor to promote the development of the industry - talent, How is the situation of quantifying private equity institutions in terms of recruitment and talent requirements??

As a headhunting agency specializing in quantitative private equity talent hunting, we randomly sampled 10 billion-level quantitative private equity and non-10 billion-level quantitative private equity, and finally selected 50 quantitative private equity institutions as samples, which covered the number of recruitment needs There are 450+.

We conduct a comprehensive analysis of the selected samples, focusing on position, education, experience, salary and other aspects. From the perspective of headhunting, we will take stock of the quantitative recruitment of private equity institutions in the first half of the year.

01 Job requirements

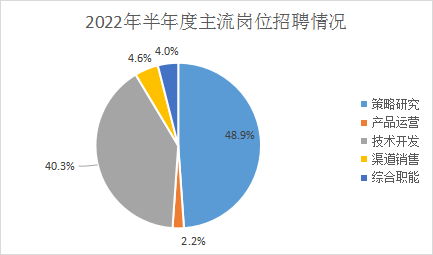

After analyzing and sorting out more than 450 recruitment requirements, we roughly divide the mainstream job recruitment in the first half of 2022 into five categories: strategy research, technology development, comprehensive functions, channel sales, and product operation.

Among them, strategic research, technology development accounted for most of the recruitment needs, which was the mainstream of the mainstream, which was generally consistent with the recruitment situation last year.

02 Academic requirements

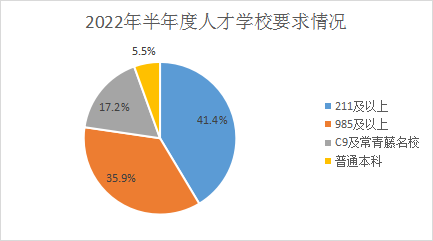

The quantitative private equity industry has always had high requirements for talents educational background, favors talents with a background of well-known universities at home and abroad as the first degree, such as domestic Qingbei reunion, overseas Ivy League, etc., if the degree reaches a master's degree or above is better.

Judging from the recruitment needs of this year in the first half of the year, the school background requirements of quantitative private institutions for talents are consistent with that of last year as a whole, preference for talents with the first degree as key institutions.

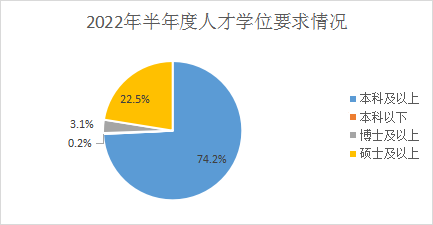

Compared with school background requirements, quantitative private equity institutions have relatively loose academic requirements. In the first half of this year, undergraduates and above accounted for the bulk of the recruitment needs, followed by masters and above, and doctorates and above.

03 Experience Requirements

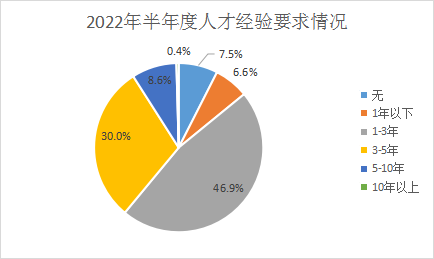

In the recruitment needs in the first half of this year, the experience requirements of quantitative private institutions for talents are mainly concentrated in the range of 1-3 years of experience, followed by 3-5 years of experience.

In addition, the experience here is mainly aimed at the experience at the technical level or research field level, and it is important to apply past professional experience to the quantitative industry, it does not require talents to have the quantitative industry. experience.

For example, a talent with experience in C++, big data development, etc., but previously worked in other industries and has no experience in the quantitative industry, but wants to apply for a technical development position related to the quantitative industry, we are very encouraged to try. Because quantitative private equity institutions are very welcome to join such talents.

04 Basic Salary

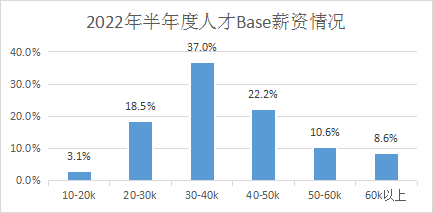

In different quantitative private equity institutions, the composition of salary is slightly different, and the reward mechanism has its own characteristics. Here, we only count the base salary, bonuses and other benefits are not included.

In terms of salary, the basic salary given by quantitative private equity institutions is mainly concentrated in the range of 30-40k, followed by 40-50k, 20-30k, and above 60k.

For personnel in core positions such as strategic research, technology development, quantitative private equity institutions are very willing to hire at high salaries. Many people with a basic salary of more than 60k correspond to talents in such core positions.

05 Summary

In general, the quantitative recruitment of private equity institutions in the first half of 2022 mainly shows the following manifestations:

For high demand for talents, the educational background of talents is still greatly attached to, especially the first degree. On the whole, the demand for talents is developing in a higher and higher direction.

In terms of experience not limited to the experience within the quantitative industry, talents who have no quantitative industry experience but have passed the technical experience are very welcome to join.

In addition, quantitative private equity institutions will provide practitioners with considerable basic salary and welfare benefits, and are willing to hire high-paying talents for some core positions.