Time: 2022-01-07 Preview:

1 China Foundation Association released the "2021 Private Fund Registration Overview"

China Foundation Association released the "2021 Private Fund Registration Overview". As of December 30, 2021, there were 24,577 surviving private fund managers registered by the Association, an increase of 16 from the end of 2020, a year-on-year increase of 0.07%; private fund management scale of 19.78 trillion yuan, an increase of 3.80 trillion yuan from the end of 2020, a year-on-year increase of 23.81%.

Brief comment: Support the superior and limit the inferior, and continue to improve the service level of the industry.

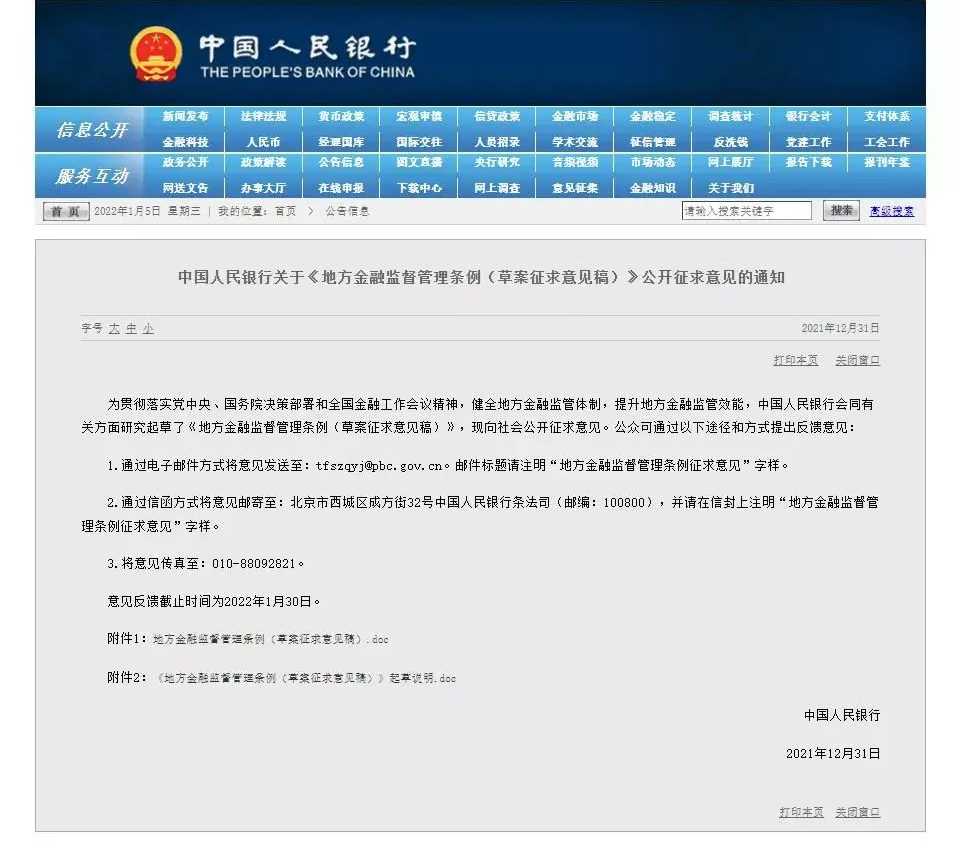

2 Private placement plans to be regulated by local financial bureaus

Recently, the People's Bank of China issued the "Regulations on Local Financial Supervision and Administration (Draft for Comments)" and publicly solicited opinions from the public. The regulations pointed out that local financial supervision and management departments should strengthen the supervision of investment companies. If it is impossible to obtain a business license or complete the registration and filing, the local financial supervision and management department shall clean up and regulate it within a time limit.

Commentary: For the private equity fund industry, it has truly entered the stage of accelerating the "clearance" and helping the superior and limiting the inferior.

3 The total scale of quantitative funds exceeded 200 billion

Data shows that by the end of 2021, the total scale of quantitative funds in the whole market exceeded the 200 billion mark, and the number of newly established funds exceeded the total of last year. In this context, fund management companies give full play to their own advantages and increase their diversified layout in the field of quantitative funds.

Commentary: Quantitative funds usher in a golden period of development, achieving both growth in performance and scale.

4 Foreign private equity "China Bank" completed 5 years

Since Fidelity Litai became the first foreign private equity manager successfully registered with the Asset Management Association of China on January 3, 2017, foreign private equity has gone through five years in the Chinese market. As of the end of December 2021, there were 35 wholly foreign-owned private securities investment fund managers, including BlackRock, Fidelity, UBS Asset Management, Bridgewater, Schroders and other world-renowned asset management institutions.

Comments: Not only in the private sector, but also in the field of public funds, WFOEs are also accelerating their competition on the same stage.

5 The top five business departments account for the third largest number of quantitative private placements

Quantitative trading has become a key variable in changing the competitive landscape of sales departments. The old-fashioned hot money gathering places gradually left the market, and the sales departments that attracted quantitative private equity backed by the strength of fintech rose rapidly. In the latest list, among the top five "top" business departments, quantitative private placement accounts for the third.

Brief comment: Quantitative trading quietly occupies a place in the Dragon and Tiger list.

6 The investment scale of Si Xie exceeded 10 billion

As of January 4, 2022, the investment management scale of Si Xie broke the 10 billion yuan mark, and it was officially promoted to the 28th domestic quantitative private equity of 10 billion yuan. So far, the number of domestic 10 billion private placements has increased to 105, and there are 28 10 billion quantitative private placements, accounting for 26.67% of the total.

Brief comment: It started from futures trading and has now completed a dual-market and multi-strategy product line.

The picture comes from the Internet, and the infringement contact is deleted