Time: 2022-01-14 Preview:

1 "Quantitative fever" spawns a technology battle for securities firms

According to incomplete statistics, in 2021, at least 26 brokerages will carry out iterations and upgrades of related service technologies around the core service categories of PB business (Prime Brokerage, prime brokerage business), such as ultra-fast trading, intelligent algorithms, trading terminals, and custody outsourcing. upgrade. In order to meet the transaction characteristics of "nanoseconds" in quantitative transactions, low-latency market services have become a must for securities firms to enter quantitative private placements.

Commentary: In attracting quantitative private equity, each securities firm has its own magic power.

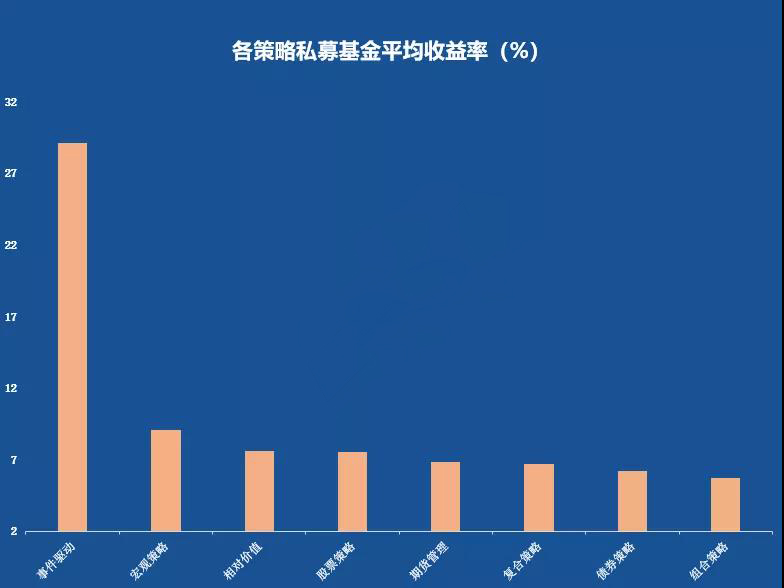

2 Private Equity's 2021 Results Released

Recently, the performance data of private equity funds in 2021 have been released one after another, and quantitative strategies have performed the most. In 2021, the average return of the private equity industry is 12.43%. In terms of strategies, the size of the scale is more than 500 million. The average return of quantitative stock long managers is 22.05%, while the average rate of subjective stock long managers is 11.5%. Programmatic futures strategy The average performance is 8.18%.

Commentary: The retracement has triggered industry thinking, but the popularity of quantitative strategies remains unabated.

3 Quantitative and re-welcome guidance, no excess loss is accrued

Recently, some brokerage custodians have recently received regulatory guidance, and there are new requirements for over-accrual products: the follow-up private equity managers cannot withdraw excess performance remuneration when the client is not making money, and the client's share cannot be withdrawn after the withdrawal is completed. in a state of loss. It is reported that the over-accrued products are mainly index-enhanced products.

Comments: Over-accrual products are not mainstream.

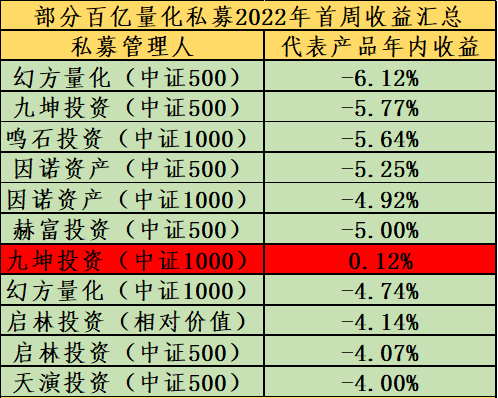

4 Funds fell in general at the beginning of the year, and quantification made a difficult start

After the start of the year in 2022, with the market adjustment, many funds have retreated significantly. In such an environment where the stock index continues to adjust and the performance of the track stocks is "pig and sheep discolored", private equity quantitative products also encountered a "difficult" start. According to statistics, a group of big-name quantitative products with the best reputation in the industry will see a sharp pullback in the beginning of 2022.

Comments: This is not only a performance difficulty, but also a "difficulty" in the investment system.

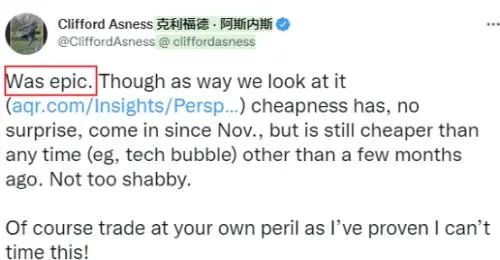

5 Quant Hedge Fund AQR Has Best First Week Performance

The absolute return fund of the world's top quantitative hedge fund AQR's first-week performance was 10.4%. As a multi-strategy product, this "starter" achieved the strongest first-week performance in the product's 23-year history; this product last year It only rose 16% for the year.

Image source: AQR co-founder Asnes posted on social media

Commentary: The king of quantification, the return of the king.

6 The 2021 Global Fund and Quantitative Investment Forum was successfully held

On January 8, the 2021 Global Fund and Quantitative Investment Forum with the theme of "The Road to Change in the Asset Management Industry" was successfully held online. The forum invites top scholars and investment experts in the field of fund investment at home and abroad to discuss and discuss the theme together, and offer suggestions. At the same time, the 2021 China Fund Billboard was released on the forum.

Brief comment: After the transition period, my country's asset management industry may usher in a new era, and there is huge room for future development.

The picture comes from the Internet, and the infringement contact is deleted