Time: 2022-01-21 Preview:

1 China Securities Regulatory Commission: In-depth rectification of fake private placements

On January 17, the China Securities Regulatory Commission held the 2022 System Work Conference. The meeting emphasized that it is necessary to carry out in-depth rectification of "pseudo private equity" and "pseudo gold exchanges" to eliminate the regulatory vacuum. The China Securities Regulatory Commission stated that it will promote the healthy development of capital regulation and steadily promote the resolution and disposal of risks in key areas.

Commentary: The classification and rectification of the private equity fund industry will enter a new stage.

2 2021 Ten Billion Private Equity List Released

On January 17, the 2021 10-billion private equity ranking list was released. Among the 105 domestic 10-billion private equity companies, 88 private equity managers have demonstrated performance, and the average return in 2021 is 12.95%. Ten billion quantified private equity in 2021 All the income If it is positive, the average return is as high as 19.32%, Mingshi Investment ranks first with a return rate of 43.23%, Jiaqi Investment and Jukuan Investment rank second and third.

Comments: Quantization still has the high cost performance of "Beta" + "Alpha".

3 The average return of stock quantitative strategy products in 2021 will exceed 20%

The data shows that the 2,781 quantitative hedge funds included in the statistics will have an average return of 15.50% in 2021. Among them, the stock quantitative strategy has become the annual champion strategy, and the annual average return of 1053 stock quantitative products is as high as 20.09%.

Commentary: The stock quantitative strategy has become the champion strategy of the year.

4 Foreign private equity increased to 38

By the end of 2021, the number of foreign private equity firms has increased to 38, but the “sense of presence” of foreign asset management in the Chinese market is still weak. At present, there are only two foreign private equity firms with a management scale of more than 5 billion yuan, and the management scale of most other foreign private equity funds is still in the range of 0 to 500 million yuan.

Commentary: Foreign private equity still needs to overcome acclimatization.

5 Huawei's Hubble Investment officially enters private equity

According to the information disclosed by the China Fund Industry Association, "Hubble Technology Venture Capital Co., Ltd." (referred to as Hubble Investment) completed the registration of private equity fund managers on January 14, and the institutional types are private equity and venture capital fund managers.

Comments: Looking forward to further private investment from Hubble Investments.

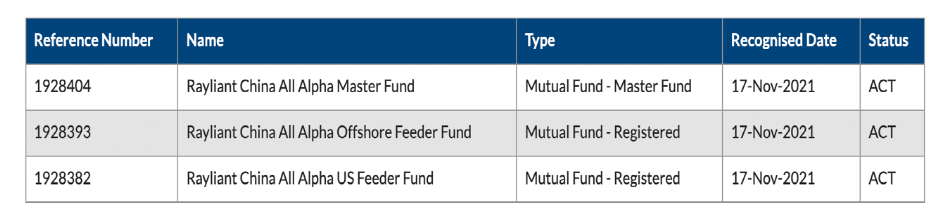

6 Global quantitative giant Ruilian issues Chinese fund

Global quantitative investment institution Ruilian registered three Chinese funds in Cayman in November 2021. Following quantitative giants such as Bridgewater, Two Sigma and Yuansheng, another well-known quantitative institution has registered Chinese funds overseas.

Comment: Offshore and onshore go hand in hand and become the choice of more and more global investment institutions.

The picture comes from the Internet, and the infringement contact is deleted