Time: 2022-01-28 Preview:

1 China Foundation Association launched the classified query and publicity portal of private equity fund managers

On January 27th, the official WeChat account of the China Foundation Association launched an entrance for classified inquiry and announcement of private equity fund managers. Users can directly jump to the association's official website through the "Private Private Equity Business - Classification Publicity" menu item at the bottom of the official account. page, you can view the information on the mobile phone without logging in to verify your identity.

Comment: This will help to promote the continuous improvement of the level of integrity construction in the private equity industry.

2 The overall situation of Shandong private equity fund industry is improving

On January 24, Shandong Private Equity Investment Fund Industry Association held its 2021 annual meeting in Jinan, and released the "2021 Shandong Private Equity Industry Statistics Annual Report". According to the "Annual Report", as of the end of December 2021, the total number of private equity fund managers in Shandong Province reached 836, the number of funds exceeded 2,800, and the fund management scale exceeded 320 billion yuan.

Comments: There is both an increase in "quantity" and an improvement in "quality".

3 Asia starts the war on quantitative talent

Selby Jennings, a world-renowned executive search firm, recently released a financial services salary review and outlook report, pointing out that the quantitative talent war in Asia continues to unfold. In order to retain talents, the year-end awards of top quantitative investment institutions match the contributions of employees to the company. It is not an exception that the year-end awards for core employees reach 10 million yuan.

Selby Jennings 2022 Quantitative Talent Compensation Guidelines (Partial)

Brief comment: High salary comes with high demands.

4 Learn from overseas experience and standardize the disclosure of private equity net worth

It is understood that the current private equity display on the tripartite platform is voluntary, and the quality of data display depends on the private equity manager's subjective willingness and degree of cooperation. Moreover, the disclosure on the third-party platform is a market behavior, and the authenticity is difficult to guarantee. From overseas experience, the more frequent the disclosure of net worth is not the better, besides the law, industry norms also play an important role in the standardization of the disclosure of net worth of hedge funds.

Comments: Do not mislead, do not avoid the important and ignore it, which is the problem that the industry needs to face urgently.

5 The tens of billions of private equity groups are nearly wiped out at the beginning of the year, and many floating losses exceed 5%

Data shows that in the first two weeks of this year, among the nearly 40 long-term stock products under the ten billion private equity group that showed performance, only 2 gained positive returns, and all others lost money. Many index-enhanced products have retraced by 5% during the year, and most of the quantitative hedging products have floating losses.

Brief Comments: The domestic economy will be stabilized in 2022.

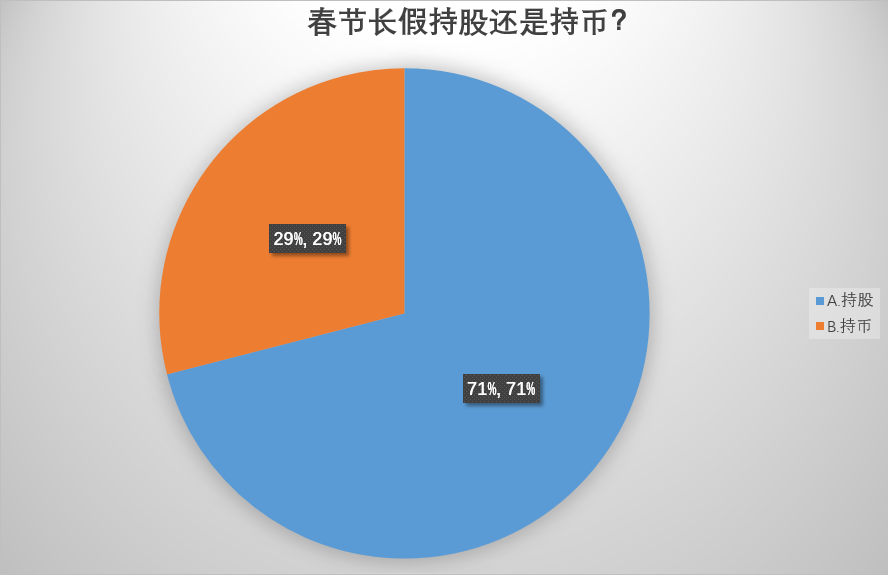

6 Over 70% of private placements choose to hold shares for the holidays

The countdown to the Spring Festival holiday is coming. Despite the recent poor market conditions, domestic private equity institutions have given optimistic choices that are close to "one-sided" on the issue of whether to hold shares or hold currency during the long holiday. According to the survey, more than 70% of the private equity institutions surveyed said they would "hold shares" for the holidays.

Comment: The market adjustment may have come to an end, and the current valuation of high-quality varieties has improved significantly.

The picture comes from the Internet, and the infringement contact is deleted