Time: 2022-02-22 Preview:

1 Vena's new 10 billion, 10 billion private equity quantification accounts for 25%

In February, Luoshu Investment entered a new 10 billion yuan, becoming the 29th 10 billion quantitative private equity. In addition, the scale of three managers including Panze Assets, Conmand Capital and Fusheng Assets also exceeded the 10 billion yuan mark. As of February 18, the number of 10 billion private placements reached 116, of which the number of 10 billion quantitative private placements accounted for 25%.

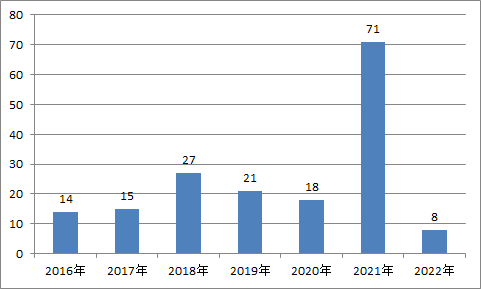

Distribution of filing time of products under Vena Investments

Commentary: When the industry fluctuated, there were also quantitative private placements bucking the trend.

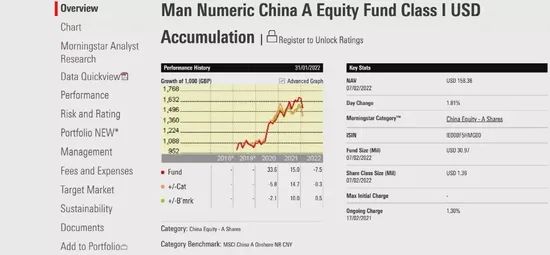

2 The number of foreign private equity fund managers has reached 40

Up to now, the number of foreign private equity managers that have completed registration and filing has reached 40, managing a total of 223 products. The first foreign private equity firm has a management scale of 10 billion yuan. Bridgewater (China) Investment, established in 2016, has officially exceeded 10 billion yuan in management scale, and there are 37 products under management.

Commentary: Most foreign private equity investors are optimistic about the long-term opportunities of A-shares.

3 U.S. private equity industry ushered in heavy regulation

The U.S. Securities and Exchange Commission (SEC) has passed a proposal that would require hedge funds and private equity funds to provide investors with quarterly reports detailing fund performance, fees and expenses, and manager compensation, while also subject to annual audits. As the domestic private equity industry continues to mature, the future of private equity supervision may also be the same trend.

Comment: The private equity industry will be more transparent.

4 DTL, an international quantitative fund company, enters the Chinese market

On February 9, Beijing Daotai Lianghe Private Equity Fund Management Co., Ltd. completed the registration of a Wholly Foreign Owned Private Equity Investment Fund Manager (WOFE PFM) at the Asset Management Association, becoming the first foreign-funded private securities investment fund manager in Beijing. It is wholly-owned by Singapore DTL quantitative investment management company (Dynamic Technology Lab Private Limited).

Brief Comment: DTL Quantitative Investment Company has been actively deploying business in the Chinese market in recent years.

5 Ten billion private equity Hefu's products hit the warning line

Following the "Hefu Flexible Hedging No. 9 Phase A Private Securities Investment Fund" under its "Hefu Flexible Hedging No. 9 Phase A Private Securities Investment Fund" on February 11, reaching the performance warning line, Ten Billion Private Hefu Investment once again apologized to investors. It also said that the management fee of the product has been adjusted to 0% since February 8, and the product will no longer charge management fees before returning to the net value of 1 yuan. At the same time, the company has co-invested 5 million yuan in the parent fund of this product with its own funds on February 10.

Brief comment: The first quantitative private placement announced that it fell below the warning line.

6 Jiukun's overseas products retreated by 40% in January

In the middle of the night on February 16, the market revealed that Jiukun Investment’s USD products, after superimposing leverage, the overall income in January dropped by nearly 40%. This product is a quantitative hedging product. If the high multiple leverage is removed, the performance is comparable to that of domestic products.

Comments: Under extreme market conditions, the performance of both public funds and private funds is quite dismal.

The picture comes from the Internet, and the infringement contact is deleted