Time: 2022-03-01 Preview:

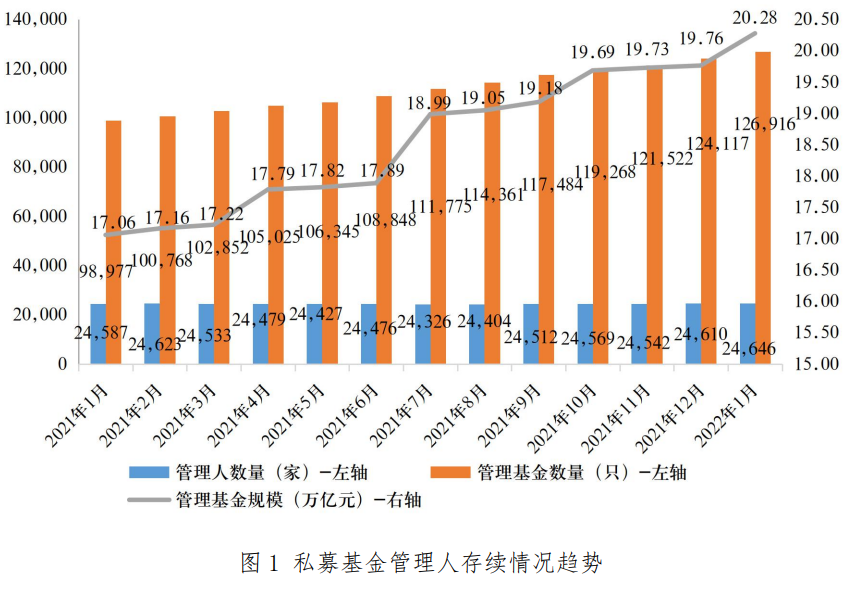

1 The scale of private equity funds exceeded 20 trillion yuan for the first time

As of the end of January, the number of domestic private equity funds totaled 126,900, a year-on-year increase of 28.18%; the total management scale increased by 18.86% year-on-year to 20.28 trillion yuan. Ten billion private placements were expanded to 115, including 29 ten billion quantitative private placements.

Comment: With the growth of the overall scale of the private equity industry, the number of private equity offerings of tens of billions of dollars has also increased rapidly.

2 The average loss of quantitative index products in the beginning of the year was 6.74%

As of February 22, the average loss of quantitative index-enhanced private equity products since 2022 was 6.74%. In addition, losses mainly occurred in January this year. As far as February is concerned, as of February 22, the average profit of the market-wide quantitative index-enhanced private equity products in February was 3.38%.

Brief comment: Quantitative track crowding is the core reason for the overall slump in performance.

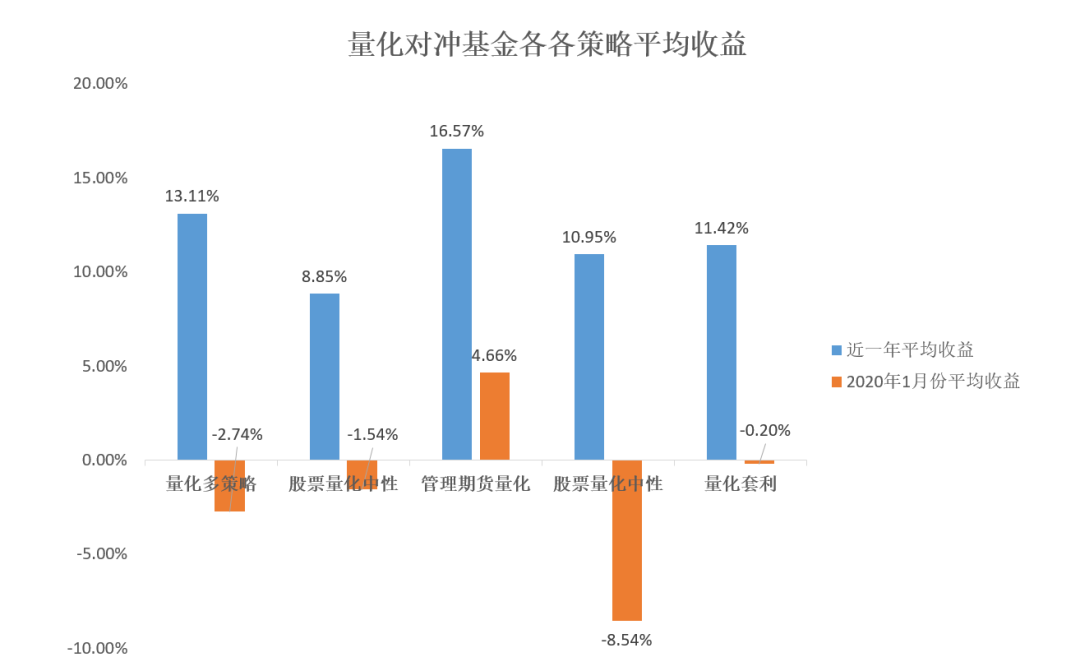

3 Quantitative CTA leads the list of quantitative hedge funds in January

The 2,532 quantitative hedge funds included in the statistics have an average return of 11.92% in the past year. Managed futures quantification has been the champion of quantitative strategies in the past year. The average return of the 415 managed futures products included in the statistics in the past year is as high as 16.57%. In January 2022, this strategy achieved an average return of 4.66%, the only strategy in the five groups that achieved a positive return.

Commentary: The stock quantification strategy has withstood a huge test, and the managed futures quantification has yielded a lot.

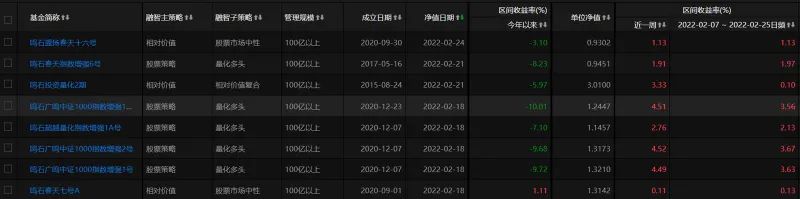

4 Mingshi Investment Development Strategy Crowding Model

In the past two years, the scale of quantitative private equity management has grown explosively, the problem of homogeneity has emerged, and the top quantitative private equity research and development competition has entered a white-hot stage. Ten billion-level quantitative private equity Mingshi Investment said that it has developed a new model for monitoring strategy crowding, which can offset the impact of strategy crowding to a certain extent. It is reported that Mingshi invested in this model after the Spring Festival, and it has performed well in the past three weeks.

Brief comment: The R&D competition has entered a white-hot stage.

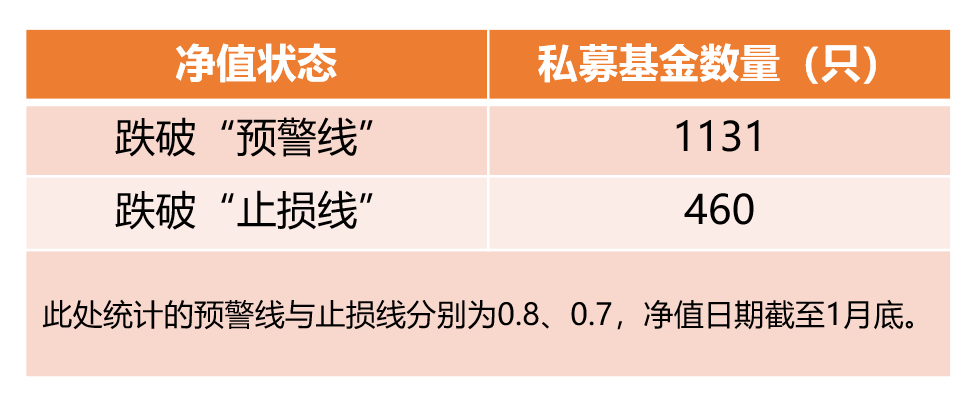

5 1,131 private equity funds fell below the warning line

As of the end of January, 1,131 private equity funds fell below the traditional warning line, that is, the net value fell below 0.8, of which 84 funds with 11 billion private equity funds were recruited. Another 460 private equity funds fell below the stop loss line, that is, the latest net value was below 0.7. And there are many stocks that are long and short, quantitative long, and quantitative trends "on the list".

Commentary: After each round of sharp adjustment in the stock market, there will be a wave of liquidation.

6 10 private equity firms announced self-purchase amounting to 1.18 billion

The data shows that this year has included Jiukun Investment, Yongan Guofu, Hanhe Capital, Lingjun Investment, Jiukun Investment, Linyuan Investment, Hefu Investment, Magic Square Quantitative, Jinglin Assets, Panyao Assets, and Hongshang Assets. Of the 10 private equity managers announced self-purchase, the accumulated/planned self-purchase amount reached 1.265 billion yuan, of which 9 were private equity managers of 10 billion yuan, and the self-purchase amount reached 1.18 billion yuan.

Comments: Self-purchasing during the slump can demonstrate the company's confidence in the market outlook and stabilize investor sentiment.

The picture comes from the Internet, and the infringement contact is deleted