Time: 2022-03-08 Preview:

1 Quantitative private equity accelerates strategy iteration

Facing the increasingly "crowded" investment track, more and more quantitative private equity funds have accelerated the pace of strategy iteration. At present, more and more quantitative private equity institutions are cooperating with financial technology platforms. The platform collects and cleans corresponding new data according to the data customization demands of private equity, and helps private equity to accelerate the pace of quantitative strategy iteration.

Commentary: The world's martial arts, only fast is not broken!

2 Several tens of billions of private equity managers have established their own portals

The latest filing and registration information shows that Shanghai Ruizhi Private Equity Fund has completed the filing, and its head is Lu Shenlin, a 27-year veteran of the financial industry; Guangzhou Mintou Private Securities Investment Fund has also recently completed the filing, and its general manager Zhang Haibin is from 10 billion Quantitative Private Equity Abama.

Brief comment: The 20 trillion private equity fund industry is attracting more and more people in the asset management circle to join.

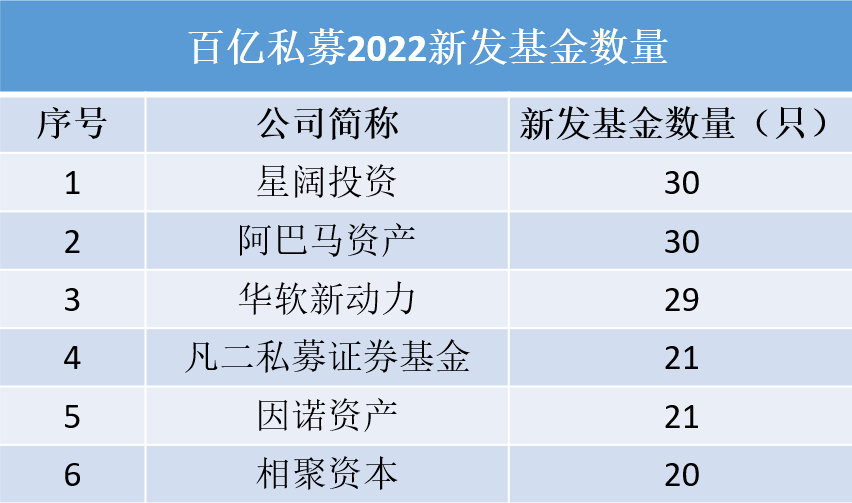

3 Quantitative private placement swept the top six of the 10 billion private placement list

Tens of billions of private equity has been "low-level bargain hunting"! As of March 2, 72 private equity funds of 10 billion yuan had been issued during the year, and the number of newly issued funds reached 562. Ten billion quantitative private placements swept the top six of Celgene's issuance list.

Commentary: Although the current market sentiment has reached freezing point, private equity is not pessimistic about the market outlook.

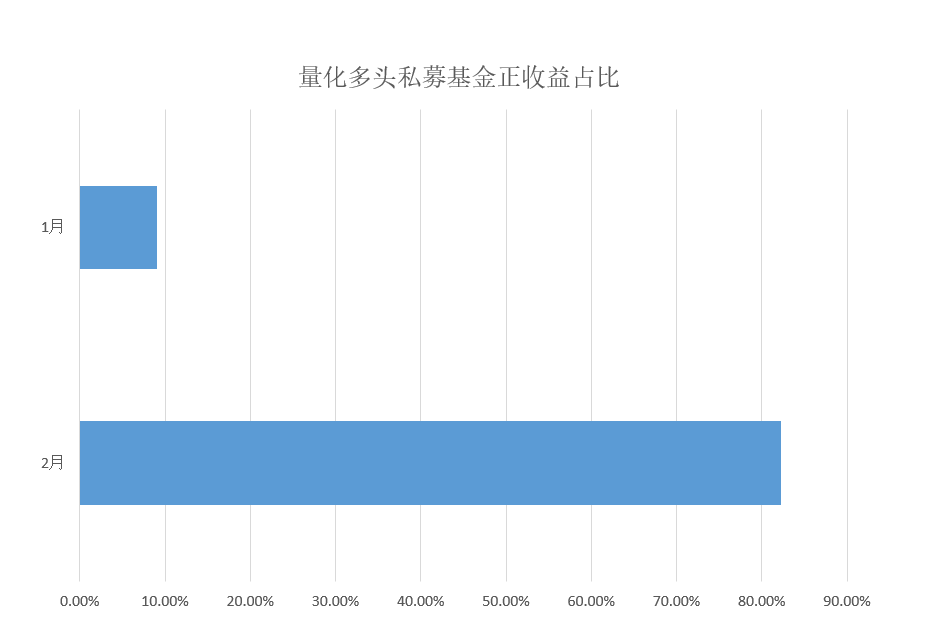

4 Quantitative bulls stopped falling in February and rebounded

Among the 559 quantitative long funds whose net worth has been updated after February 25, 82.29% of them have made money in the past month, and 95% of the quantitative long funds under the ten billion quantitative private equity fund have an average return of 3.46% in February. -The average return of the 10 billion private equity long-term fund in February was 3.56%.

Comment: The net value of quantitative funds recovered in February, and the performance of quantitative long funds was particularly significant.

5 Ten billion private equity fund managers have annualized over 10% in five years, accounting for nearly 30% quantitatively

Judging from the performance of 10 billion private placements in the past five years, there are 37 fund managers whose five-year annualized returns exceed 10%, mainly stock long private placements, with a difference of 2862.56% between the beginning and the end. There are ten billion-dollar quantitative private fund managers on the list, accounting for 27.03% of the total.

Brief comment: With the trend of tens of billions of people becoming "younger", the explosive power of performance has become more and more obvious.

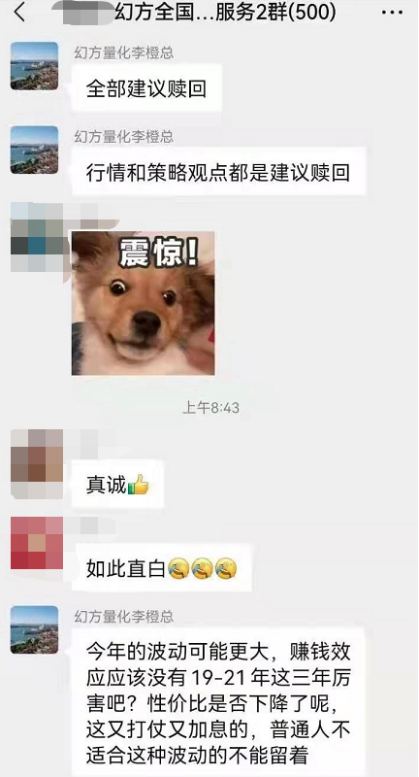

6 Quantitative giant magic square recommends investors to redeem

On March 4, the news that Magic Square Quantitative Marketing Director "persuaded redemption" in the channel group was widely circulated on social media, arousing market attention. The Quantitative Marketing Director of Magic Square believes that the market volatility this year may be greater, and the profit-making effect may not be as good as the past three years. Ordinary investors who are not comfortable with such fluctuations are not advised to hold products.

Comment: Rational investment, after all, all industries, products, and economies have cycles.

The picture comes from the Internet, and the infringement contact is deleted