Time: 2022-03-22 Preview:

1 Guangdong conducts annual self-examination of private equity

On March 15, the Guangdong Securities Regulatory Bureau issued the "Notice on Carrying out the Self-Inspection of Private Investment Funds in the Jurisdiction in 2022", requiring all private equity fund managers in the jurisdiction to carry out self-inspection according to the requirements of the notice, and the deadline is April 30. The self-examination draft covers seven key contents, including publicity and promotion, fund raising, fund investment, internal control and risk management, information disclosure and submission, and investor suitability. It also pays attention to whether private equity carries out quantitative transactions, involves real estate-related industries, and whether it is engaged in business that conflicts with or has nothing to do with private equity fund management.

Brief Comment: The self-examination of private equity funds in Guangdong Province officially kicked off.

2 Hedge funds run into cryptocurrency

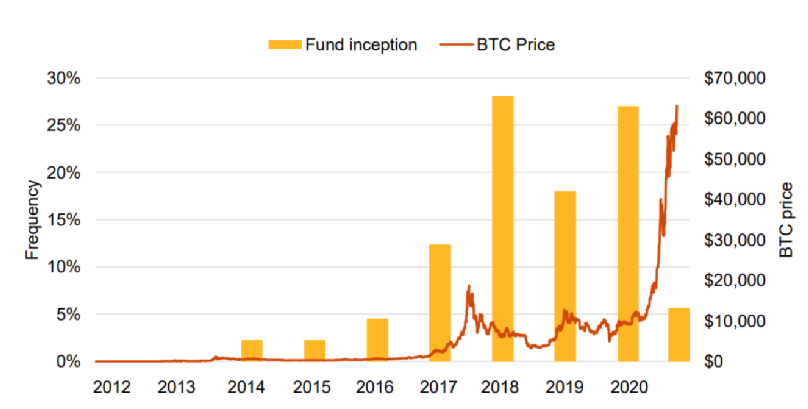

According to the 2021 Hedge Fund Industry Report, 21% of hedge funds currently invest in digital assets, and the investment amount accounts for an average of 3% of their assets under management. Additionally, 86% of hedge funds that have already invested in cryptocurrencies plan to increase their investments, while 26% of hedge funds that have not yet said they are in the final stages of planning an investment or executing an investment decision.

(Number of Newly Issued Crypto Hedge Funds vs. Bitcoin Price Movement)

Brief comment: Cryptocurrencies and hybrid funds may dominate the hedge fund issuance market this year.

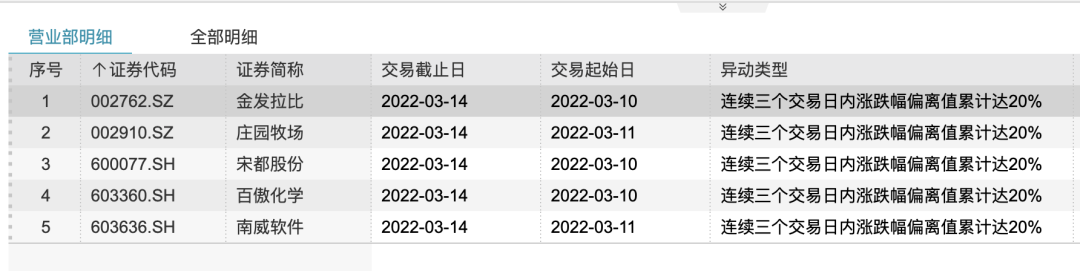

3 Quantitative base camp's absence from the Dragon Tiger list conjecture

On March 15, the seat of Huaxin Securities Shanghai Branch, the “quantitative base camp”, was absent from the Dragon and Tiger list, causing many speculations in the market. According to the data, Huaxin Securities has been on the list for the past few days, and it has been absent from the Dragon Tiger List for 4 consecutive trading days from March 15 to March 18. Huaxin Securities stated that it will continue to control the abnormal trading behavior of customers in accordance with the requirements of the exchange, and will not pay attention to the trading results and various lists.

(On March 14, 5 stocks of Huaxin Securities Shanghai Branch were listed)

Brief comment: The strategy of hitting the list is only one of the various strategies of quantitative private placement.

4 Jiukun will invest 10 million per month in the next three years

On the 18th, Jiukun Investment announced that based on its confidence in the long-term and stable development of China's capital market, and to practice the long-term investment concept with investors, the company decided to adopt a monthly fixed investment method from March 18th, with its own funds. To subscribe for its stock asset management products, the monthly fixed investment amount is 10 million yuan, and the fixed investment cycle is 3 years.

Commentary: Jiukun Investment is not an isolated case. Many leading private equity firms have announced that they will make their own purchases.

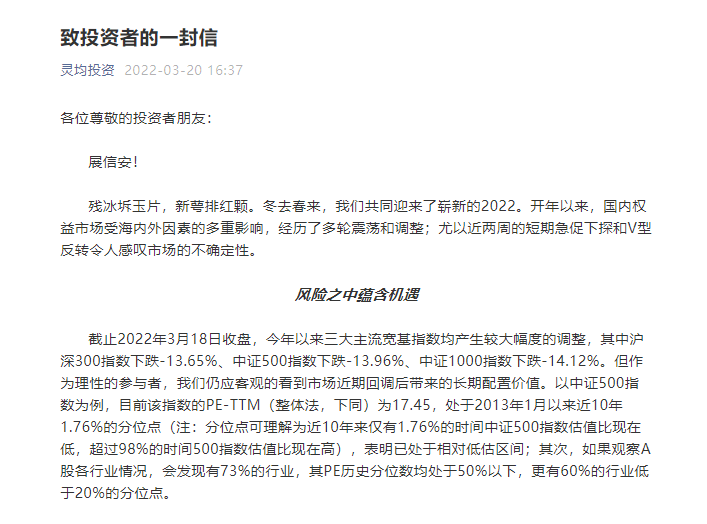

5 Lingjun: firmly believe in the long-term allocation value of quantitative investment

On March 20, Lingjun Investment released a "Letter to Investors" stating that since the fourth quarter of 2021, the equity market and the quantitative industry have undergone major changes, and the company's model has also been tested in stages. Under the continuous adjustment, the performance of the model side has been trending better recently. And said that he still firmly believes in the long-term allocation value of quantitative investment.

Commentary: The wind never ends, and the shower never ends.

6 Magic Square denies 40% of new energy holdings

There are market rumors that 40% of the positions held by the quantitative giant Magic Square are new energy sources. Liang Jian, Marketing Director of Magic Square Quantitative, denied this on March 15, and said that Magic Square is relatively balanced in the style of the entire industry. Liang Jian introduced that Magic Square reduces the impact of market fluctuations on performance by reducing the overall position concentration. After optimization, the performance has improved compared to the fourth quarter of last year, but it has not returned to an optimal state.

Comments: The market rebound is more likely.

The picture comes from the Internet, and the infringement contact is deleted