Time: 2022-04-12 Preview:

1 Confidence in private equity investment

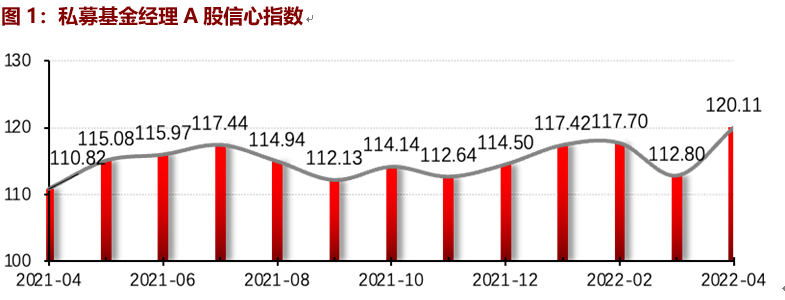

In the context of the overall bottoming out of the A-share market since mid-March, the current private equity industry's overall investment confidence in A-shares has improved significantly. According to the April A-share Investment Confidence Index Monthly Report of Private Fund Managers, as of the beginning of April, the A-share confidence index of private fund managers was 120.11 points, a sharp increase of 7.31 points from the previous month. year highs.

Commentary: In the case of exhaustion, the investment confidence of private equity fund managers has been significantly improved.

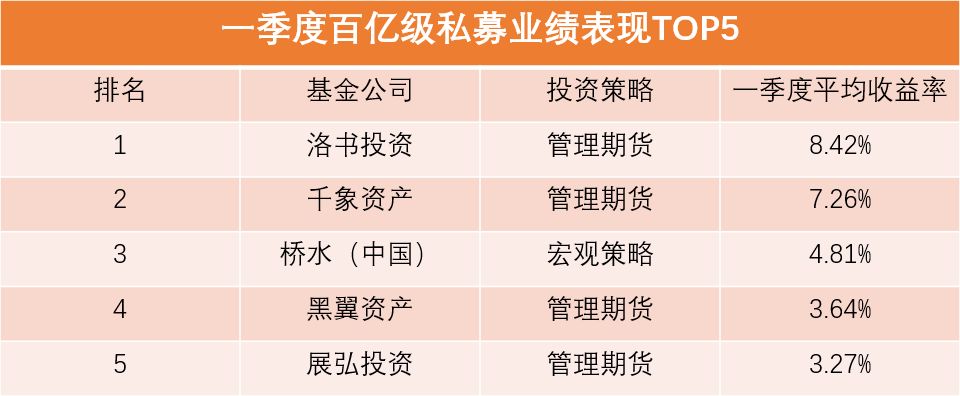

2 Ten billion private equity first quarter earnings released

The first quarter ended, and the market was volatile and down, and most of the tens of billions of private equity was also severely beaten. Data shows that the overall loss of 10 billion private equity in the first quarter exceeded 9%, and only 8 10 billion private equity companies achieved positive returns, accounting for less than 10%. In the view of research institutions, the market slump is the best way to test private equity, and it is now a critical moment to identify the level of managers.

Commentary: Most quantitative private equity performance has not been repaired.

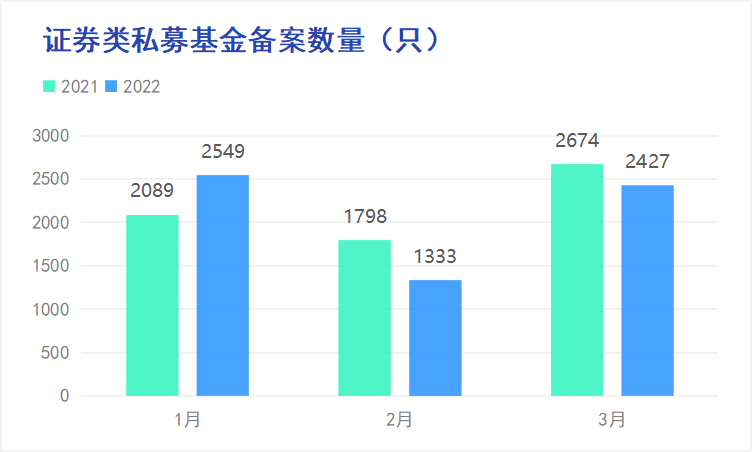

3 2,383 private equity funds filed in the first quarter with 6,309 funds

According to incomplete statistics, in the first quarter, a total of 2,383 securities private equity managers filed funds, and the cumulative number of private equity funds filed was 6,309, a drop of only 3.84% compared with 6,561 in the same period last year. During the year, 76 private equity firms with 10 billion yuan issued new funds issued 728 funds this year, accounting for only 11.54% of the total.

Brief comment: The reason for the slowdown in the number of new funds issued by giant private equity in 2022 is still related to performance.

4 The average loss of domestic quantitative strategy private equity products in the first quarter was 3.63%

The private equity performance monitoring data in the first quarter showed that over 4,000 quantitative private equity products of various strategies lost an average of 3.63%, and only slightly more than 30% of the products achieved positive returns during the same period. At the same time, in the context of the continued bull market performance of the commodity futures market in the first quarter, more than 2,000 CTA strategic private placement products made an average net profit of 4.52% in the same period, of which about 60% of the CTA strategic products made profits.

Commentary: CTA strategy private equity products become winners.

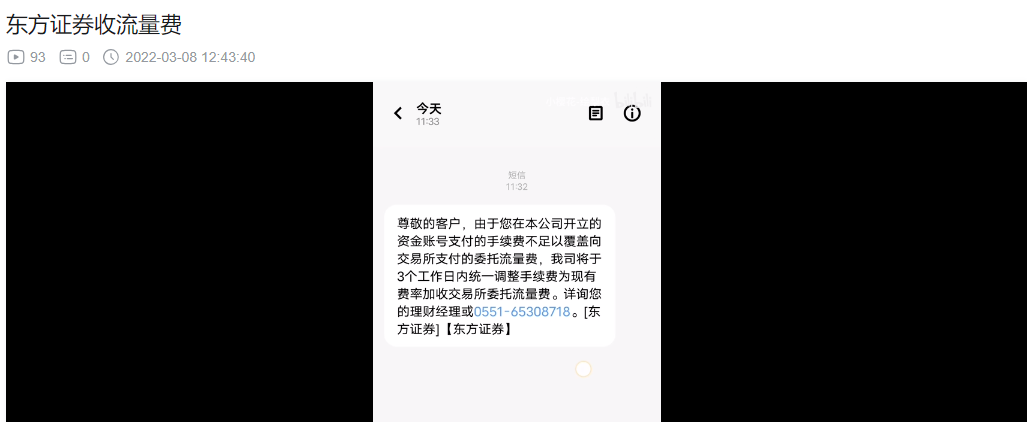

5 "Traffic fee" first appeared in the rivers and lakes, and the securities companies urgently stopped

Recently, regarding the "traffic fee" charged by securities companies, the new phenomenon of quantitative trading has attracted the attention of the industry. The two brokerages that charge traffic fees are Orient Securities and Sinolink Securities. Among them, on March 8, Orient Securities officially issued a notice to the customers who were "free in case of five", and implemented the traffic fee collection within 3 working days. It is worth noting that Orient Securities responded that after investigation, it has urgently stopped the above-mentioned charging business.

Commentary: Traffic fees should not be passed on to investors.

6 Star fund managers run away one after another

According to the reporter's incomplete statistics, as of April 6, nearly 10 public fund managers have "run away" this year. A total of 88 fund managers left during the year, involving 64 fund companies. Compared with the data of the same period in previous years, it has reached a record high.

Commentary: Public and excellent are private.

The picture comes from the Internet, and the infringement contact is deleted