Time: 2022-04-26 Preview:

1 During the year, 16 private equity companies purchased more than 2.5 billion yuan

When the stock market adjusts, many private equity institutions have increased investor confidence by purchasing their own funds. According to incomplete statistics, as of April 22, 16 private equity firms have announced self-purchase since the beginning of this year, with a self-purchase amount of 2.585 billion yuan, of which 12 are 10 billion private equity firms, with a self-purchased amount of 2.458 billion yuan. At present, a number of private equity purchase plans of 100 million yuan have been completed, and Lingjun Investment and Magic Square Quantification are among them.

Comment: Ten billion private equity is the main force involved in self-purchase.

2 Brokerage asset management challenges are heavy, and quantification may become a nirvana

With the withdrawal of the secondary market, the product issuance of the whole industry is obviously cold. In addition, after the implementation of the new asset management regulations, the asset management of securities companies has encountered a downturn in the industry for the first time, and there is still a lot of experience to accumulate in channel maintenance and investor companionship. Many brokerage asset management is working on the subdivision of the track. Specifically, quantitative index-enhanced products are becoming an asset allocation tool for investors due to their wide coverage, high win rate, and rational decision-making.

Brief comment: Quantitative track welcomes a good opportunity for configuration.

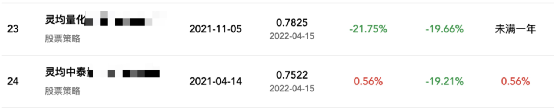

3 More than 1,000 products fell below the warning line

Under the drastic adjustment, some products of a certain tens of billions of private equity fell below the warning line. As of April 20, there were 1,465 private placement products with a cumulative net worth of less than 0.85 yuan, including 1,192 stock strategy products; a total of 544 private equity products with a cumulative net worth of less than 0.7 yuan, including 460 stock strategy products.

Commentary: The market fluctuated and adjusted, and the net value of some private equity products flashed a "red light" again.

4 "Double line" setting re-introduces controversy

The news that the net value of tens of billions of private equity products has fallen below the warning line has spread, causing the "double line" setting to once again cause market controversy. Although the setting of the warning line and the stop-loss line can control the maximum loss of investors within a certain range, in the market adjustment, the setting of "double lines" will make fund managers passively lighten their positions, thereby increasing market volatility. The top private equity firms are negotiating to lower the "double-line" level.

Comments: The "double line" setting is a double-edged sword.

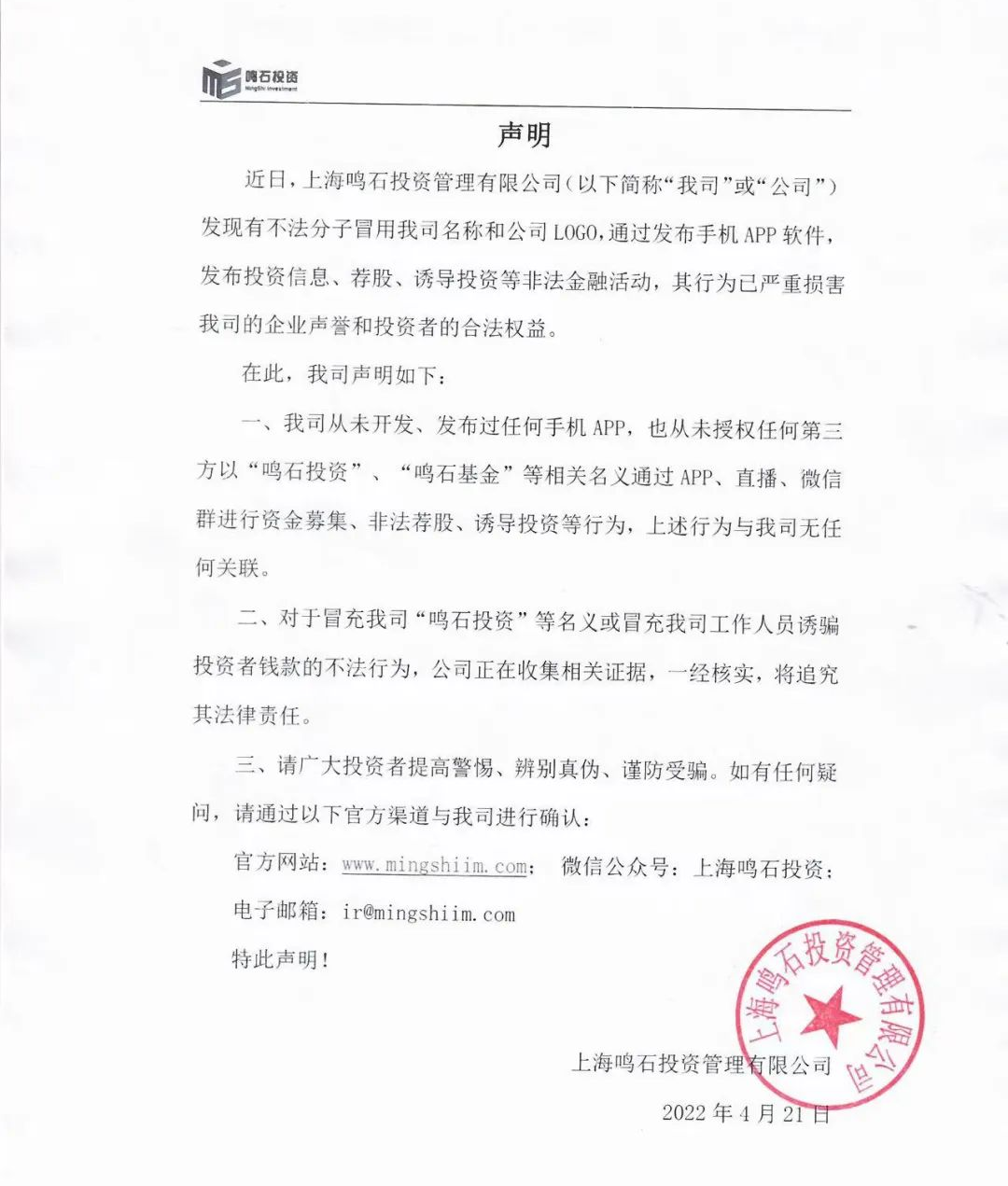

5 Mingshi issues statement on impersonation and illegal financial behavior

On the evening of April 21, Ten Billion Quantitative Private Equity Mingshi Investment issued a statement saying that the company has never developed or released any mobile APP, and has never authorized any third party to use the names of "Ringshi Investment", "Ringshi Fund" and other related names. Fundraising, illegal stock recommendation, and investment inducement through APP, live broadcast, and WeChat groups are not related to the company in any way. For wrongdoing, the company is collecting relevant evidence, and once verified, it will pursue its legal responsibility.

Comments: Investing needs to be vigilant, distinguish authenticity, and prevent deception.

6 Global asset management giant BlackRock's latest voice

On the evening of April 19, BlackRock, a world-renowned investment institution, held an online exchange meeting. He also said that there is still room for further expansion of China's economic stimulus policies. The allocation of Chinese assets by global investors is very low, so there are reasons to increase the allocation of Chinese assets, especially Chinese bonds. A lot of pessimism has been priced into the stock price, and valuations and earnings have turned around.

Commentary: In the medium and long term, some major trends have not changed.

The picture comes from the Internet, and the infringement contact is deleted