Time: 2022-05-17 Preview:

1 10 tens of billions of private equity companies achieved positive returns within the year

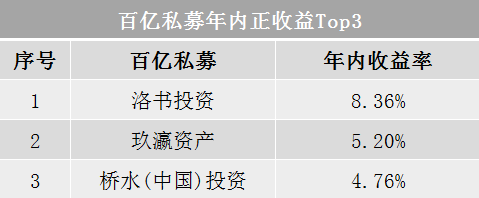

The latest data shows that 10 private equity firms with 10 billion yuan led by Vena Investment achieved positive returns within the year. Judging from the core strategies of the 10 billion-dollar private placements that have achieved positive returns, managed futures strategies and bond strategies have obvious advantages. 4 core strategies are managed futures strategies, and 3 core strategies are bond strategies.

Brief comment: Managed futures strategies and bond strategies shine in the current market.

2 Commodity market turbulence, private equity is optimistic about CTA products

Since April, the commodity market has experienced severe "bumps", and some people believe that the bull market is nearing an end. However, many tens of billions of private equity people believe that from the perspective of fundamentals and market transactions, it is too early to conclude that the commodity bull market is over, and the high volatility of the short- and medium-term market may continue. From the perspective of strategy operation, the CTA (Commodity Trading Advisor) strategy is expected to still face a more favorable operating environment.

Comment: In a high volatility market environment, the CTA strategy has obvious advantages.

3 The thinking dimension of top private equity stock selection has increased

According to the reporter's understanding, in the process of research and stock exchange, the top private equity companies have added a new dimension of thinking in addition to the popular track represented by new energy and "high prosperity" as the beauty pageant criteria: "reverse Thinking, "reasonable valuation", "policy support", "high performance certainty", "poor expectations", "expanding industry coverage", etc.

Comments: Pay attention to market cognitive biases and refuse to label stocks.

4 China Securities Regulatory Commission Launches National Anti-African Publicity Month

The China Securities Regulatory Commission launched the 3rd National Prevention of Illegal Securities and Futures Publicity Month. The focus of publicity includes prevention of illegal recommendation of stock and fund futures, private equity funds in violation of laws and regulations, over-the-counter funds, black mouths in the stock market, illegal issuance of stocks, illegal wealth management on behalf of clients, and overseas institutions. Risks such as providing cross-border securities and futures fund trading services, counterfeiting and counterfeiting securities and futures fund operating institutions, and illegal fundraising.

Commentary: Say "no" to illegal securities and futures and establish a rational investment concept.

5 Private Equity Industry Integrity and Self-discipline Proposal Released

On May 15, the "Private Fund Investor Protection Exhibition" sponsored by China Foundation Association and others opened online and released the "Private Fund Industry Integrity and Self-discipline Proposal", advocating practitioners to stick to their professional bottom lines. At the same time, it calls on private equity fund managers to improve their awareness of compliance operations and build a benign industry development ecosystem.

Commentary: The sound development of the private equity industry is inseparable from practitioners' adherence to the professional bottom line.

6 China Foundation Association: the founding meeting of the mediation committee and the first plenary meeting

Recently, the Asset Management Association of China held the inaugural meeting and the first plenary meeting of the Mediation Committee. It is reported that in recent years, the China Foundation Association has resolved a total of 478 industrial disputes through mediation and reconciliation. Among them, more than 90% of the cases involved private equity funds, helping investors recover more than 4.6 billion yuan in economic losses.

Brief Comment: Stand firm on the people's position and strictly perform the statutory duties of dispute mediation in the fund industry.

The picture comes from the Internet, and the infringement contact is deleted