Time: 2022-05-24 Preview:

1 A number of private equity firms said they would choose to increase their positions

Recently, the A-share market has stabilized at a low level, and the profit-making effect of individual stocks has improved significantly, and the overall trend is positive. In terms of position management, a number of first-tier private equity firms said that at this stage, they would “not hesitate” to continue to increase positions.

Comment: Investment confidence continues to pick up.

2 Shenzhen Private Equity Association plays a significant role in fighting the epidemic

Since the beginning of the epidemic in Shenzhen, Shenzhen Private Equity Association has led the fight against the epidemic with party building, and has effectively taken up the political responsibility of epidemic prevention and control; uploaded and released, built a bridge between supervision and the market; supported Hong Kong and served the overall situation of "one country, two systems"; , the online work does not stop.

Brief comment: The association has firmly shouldered the responsibility of fighting the epidemic.

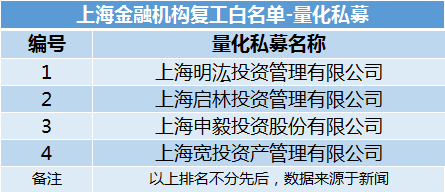

3 Shanghai's first batch of "white list" of financial institutions to resume work released

Shanghai's first batch of "white list" of financial institutions to resume work has been released, with a total of 864 financial institutions. Among them, four quantitative private equity firms including Mingye Investment, Qilin Investment, Shenyi Investment, and Kuan Investment Property are on the list. In principle, a "whitelist" is published once a week.

Brief Comment: The resumption of work and production of financial institutions in Shanghai is progressing steadily.

4 U.S. to take tougher stance on private equity

The top U.S. antitrust enforcement agency has warned that the Justice Department will take a tougher stance on private equity firms’ expansion in the U.S. economy, targeting buyout groups that have largely evaded regulatory scrutiny.

Commentary: US private equity funds may be more difficult to enter the market.

5 Shenzhen Jiali rectifies private equity funds in compliance with regulations

The scale of private equity in Shenzhen is growing rapidly, and it is urgent to protect the rights and interests of investors. In this regard, Shenzhen Securities Regulatory Bureau continued to clear "red" institutions, urges "yellow" institutions to turn green, and supports "green" institutions' compliance and steady development. Shenzhen's private equity industry continues to consolidate its high-quality development foundation.

Brief comment: Compliance rectification is conducive to the sound development of the private equity industry.

6 Egret Assets has become a new member of tens of billions of private equity

As of May 20, the tens of billions of private equity has added "new recruits". The scale of Egret Asset Management's registration in the association has exceeded 10 billion, and the official "official announcement" has become a 10 billion private equity.

Commentary: The multi-strategy model helps Egret break through the 10 billion mark.

The picture comes from the Internet, and the infringement contact is deleted