Time: 2022-05-31 Preview:

1 The performance of quantitative index strategy products has rebounded significantly

Since May, private equity quantitative index products have performed relatively well. According to industry analysis, this is due to the double rebound of Beta and Alpha, the improvement of liquidity, the return of style, and the decline of crowding, etc. However, the short-term excess has a great relationship with the market and is random. It is recommended that investors pay more attention to the long-term excess.

Brief comment: Quantitative industries and products need to be viewed from a long-term and developmental perspective.

2 Ten billion quantified private equity income rankings released during the year

The latest data shows that the average returns of the quantitative products included in the statistics of Luoshu Investment, Si Xie Investment, and Blackwing Assets this year have ranked in the top three respectively. These three tens of billions of private equity institutions are all good at quantitative CTA strategies.

Brief comment: The head quantification product performed well.

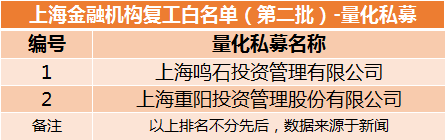

3 Shanghai's second batch of whitelists for financial institutions to resume work announced

The second batch of "whitelists" of financial institutions to resume work and production in Shanghai has been released, involving 240 financial institutions. So far, a total of 1,104 financial institutions in Shanghai have joined the resumption team. Among them, Mingshi Investment, Chongyang Investment and other two quantitative private equity institutions are on the list of resumption of work.

Commentary: A number of financial institutions in Shanghai are resuming work in an orderly manner.

4 Foreign private equity actively deploys in China

According to the latest data, 37 foreign private equity firms with incomplete statistics have a management scale of about 58.5 billion yuan, and the attractiveness of China's asset allocation is still increasing. In addition, the entry of foreign private equity will further intensify the competition in the industry, and domestic private equity funds should accelerate their core competitiveness.

Comment: The competition in the domestic private equity industry will become increasingly fierce.

5 Citadel, the world's top institution, speaks loudly

The Asian hedge fund industry is growing rapidly, and competition for talent is fierce among institutions. Kristina Knoll Martinez, the managing director of Citadel, the world's top institution, said that Citadel will continue to expand its talent team in Asia, including China, and its determination to deploy in China will not change.

Comment: Institutional expansion is inseparable from talent expansion.

6 Overseas Chinese ETFs resume strong inflows

With the improvement of the epidemic situation, overseas institutions have recently returned to the carbine, and many overseas-invested Chinese products have recently resumed purchases. The world's first China A-share active ETF listed on the New York Stock Exchange, a well-known quantitative investment institution, has received substantial subscriptions against the trend. Now its management scale has exceeded 100 million US dollars.

A comparison chart of the ETF RAYC, which has a record-breaking scale, and the ETF ASHR that tracks the CSI 300

Comments: At present, investor sentiment towards the Chinese market has improved marginally.

The picture comes from the Internet, and the infringement contact is deleted