Time: 2022-06-21 Preview:

1 From January to May, the list of private placements with positive income of 10 billion yuan was released

After the rebound in May, the number of private equity firms with positive income of 10 billion yuan increased to 12 during the year, and Vena Investment ranked first. Among them, the tens of billions of private placements with positive returns are mainly managed futures private placements and bond strategic private placements.

Comments: Managed futures strategies and bond strategies performed well.

2 Private Equity Nuggets Digital Transformation Investment Opportunities

Affected by the epidemic, the digital transformation of physical enterprises has been further accelerated. Many securities private placements regard digital transformation as a key investment theme, and conduct forward-looking research and opportunistic layouts from a fundamental perspective.

Brief Comment: Focus on the digital transformation of enterprises.

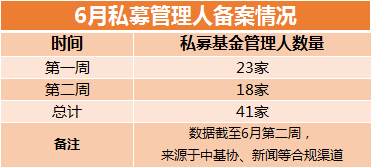

3 Private equity manager filing bottomed out in June

With the recovery of the capital market, the enthusiasm of private fund managers for filing has picked up. Data show that in the first half of June, the number of private equity fund managers registered reached 41, a month-on-month increase of 46.43%.

Commentary: The filing of private equity managers is obviously affected by the market.

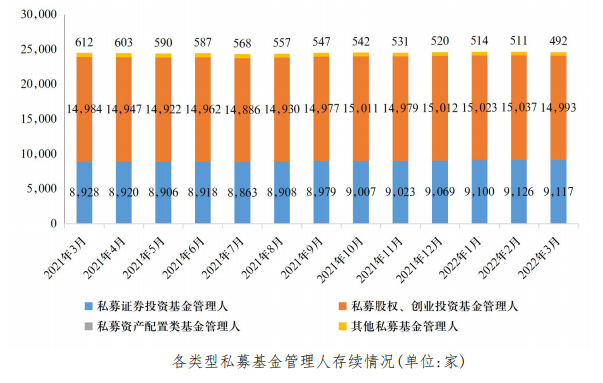

4 The scale of private securities funds may exceed 7 trillion by the end of the year

According to the latest data, as of the end of March 2022, there were 9,117 registered securities private fund managers and 81,002 securities private fund products; the management scale was about 6.35 trillion yuan. Industry professionals believe that the scale of private securities funds is expected to exceed the 7 trillion yuan mark by the end of the year.

Commentary: The scale of private equity funds continues to expand.

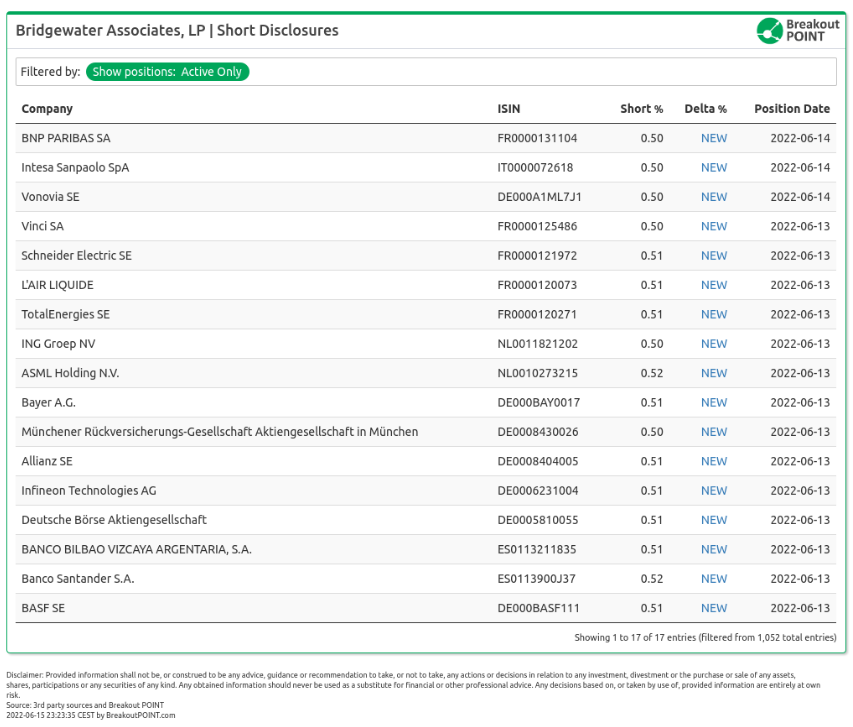

5 World's largest hedge fund shorts European stocks

It is understood that Bridgewater, the world's largest hedge fund, has recently shorted European companies on a large scale. Bridgewater has taken about $5.7 billion worth of short positions in 17 European companies, betting on a decline in European stocks, according to June 15 Breakout Point data.

Commentary: Bridgewater's large-scale shorting of European stocks is rare.

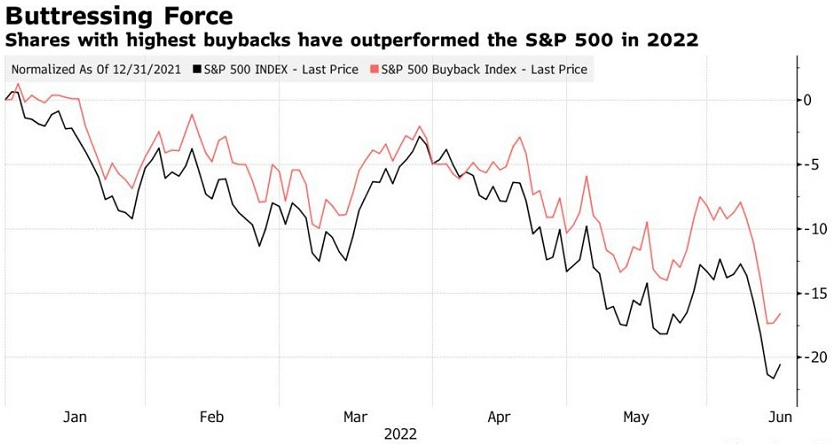

6 Hedge Funds Frenzy Withdrawing From U.S. Stock Markets

Institutional investors fled U.S. stocks at a record pace as a vicious sell-off sent the S&P 500 into a bear market. Hedge funds tracked by Goldman Sachs cut their holdings of U.S. stocks for the seventh straight day on Monday.

Comment: The market decline is getting worse.

The picture comes from the Internet, and the infringement contact is deleted