Time: 2022-06-28 Preview:

1 China Foundation Association discloses the latest data on private equity funds

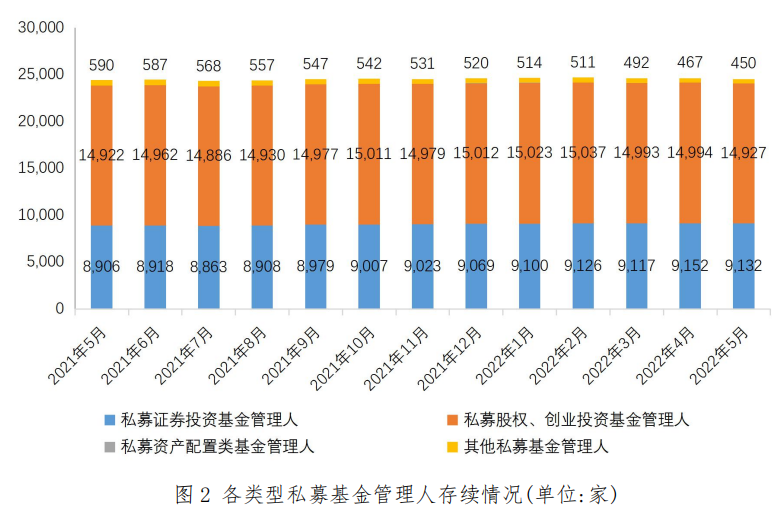

Data show that as of the end of May this year, there were 24,518 private equity fund managers in existence, with a fund scale of 19.96 trillion yuan. From the perspective of the geographical distribution of private funds and the scale of funds under management, the top three jurisdictions are Shanghai, Beijing and Shenzhen.

Brief Comment: The existing scale of private equity funds decreased slightly in May.

2 Ten billion private equity increases for three consecutive weeks

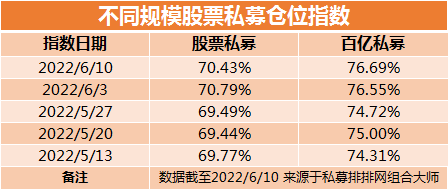

Recently, private equity positions have gradually recovered. As of June 10, the private equity position index of 10 billion stocks was 76.69%, an increase of 0.14% from the previous week. This is the third consecutive week that the private equity position index of 10 billion stocks has risen.

Commentary: Market sentiment is gradually picking up.

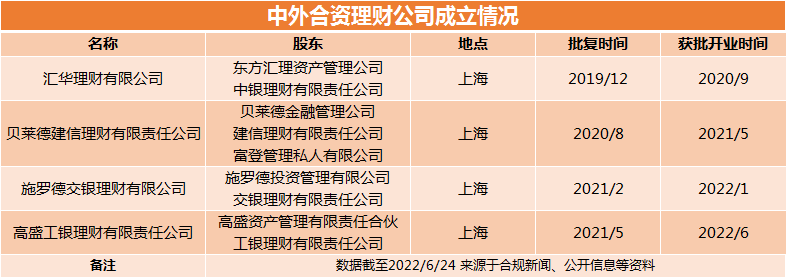

3 The fourth joint venture wealth management company was approved to open

Recently, Goldman Sachs ICBC Wealth Management, jointly established by Goldman Sachs Group and ICBC, was approved to open for business. Goldman Sachs stated that it will develop and launch a series of comprehensive wealth management products in the Chinese market after the official launch, including but not limited to quantitative investment strategies, cross-border wealth management products and alternative innovative solutions.

Comment: Joint venture wealth management will bring new vitality to the asset management market.

4 Quantitative giant Two Sigma's new products are hot

Recently, the international quantification giant Two Sigma's new product sales in China are hot, and it will be sold in seconds after its release. It is understood that its fundraising scale is about 1.2 billion yuan, and the subscription is basically completed.

Comment: Two Sigma products are recognized by investors.

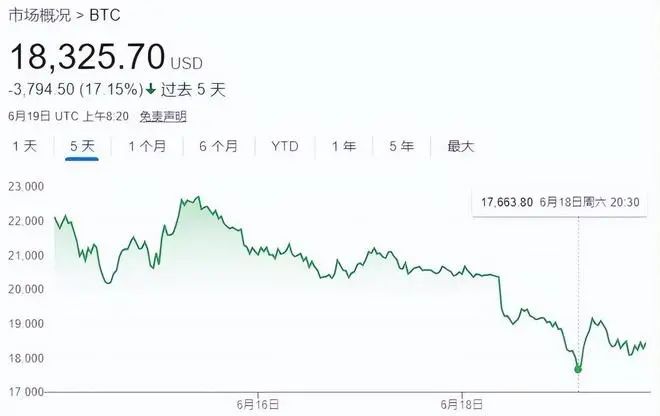

5 Crypto Hedge Funds Slumped in May

Cryptocurrency hedge funds fell 18% in May, the biggest drop since May 2021 and the biggest drop of any type, according to the Bloomberg Hedge Fund Index.

Brief comment: The cryptocurrency market is not optimistic.

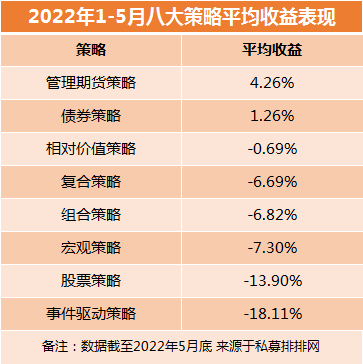

6 Private equity CTA strategy drawdown attracts heated discussions

Recently, the CTA strategy, known as "crisis alpha", has fallen into a retreat, and its ability has been questioned by the market and has sparked a big discussion in the industry. Industry professionals believe that the CTA retracement is mainly affected by the Fed's interest rate hike.

Commentary: CTA strategy retracement needs to be looked at comprehensively.

The picture comes from the Internet, and the infringement contact is deleted