Time: 2022-08-02 Preview:

1 Ten billion private equity scale exceeded 110

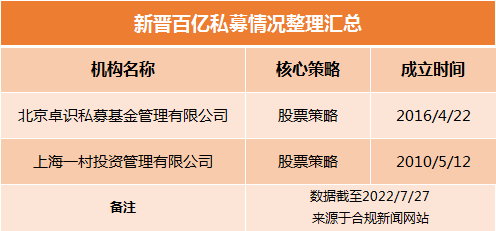

Data from third-party institutions shows that the number of domestic private equity firms with 10 billion yuan has exceeded 110, and private equity institutions such as Zhuozhi Private Equity and Yicun Investment have become new tens of billions of private equity in the industry.

Brief comment: The scale of head private placements has expanded.

2 The scale of private asset management business reaches 15.4 trillion

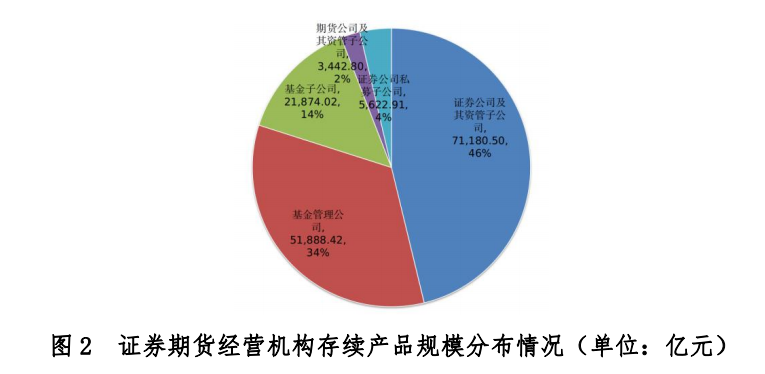

Data show that as of the end of June 2022, the private asset management business scale of securities and futures institutions totaled 15.4 trillion yuan (excluding social security funds and corporate annuities). Securities and futures institutions registered a total of 819 private asset management products in June, with an establishment scale of 52.158 billion yuan.

Comments: The scale of establishments in June increased month-on-month.

3 The development of private equity fund industry is moving from quantity to quality

Recently, Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said that my country's private equity fund industry has developed from a niche industry to an important part of the asset management industry, and has begun to move from quantitative growth to qualitative development.

Commentary: The development of the private equity fund industry has entered a new stage.

4 First-tier private equity is "cautiously optimistic" about the market outlook

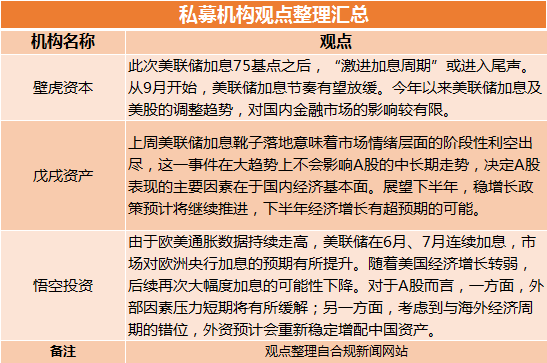

The Fed raised interest rates by 75 basis points last week and provided further clarity on future monetary policy. In this context, the latest strategic research from the private equity industry shows that most private equity institutions are currently "cautiously optimistic" about the A-share market outlook."

Comments: optimistic about the later market development but remain cautious.

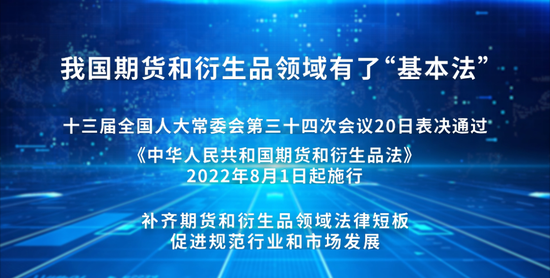

5 Implementation of Futures and Derivatives Law

On August 1, the "Futures and Derivatives Law of the People's Republic of China" came into effect. Many professionals in the industry said that the introduction of the Futures and Derivatives Law has played a key role in the healthy development of the futures industry.

Comment: Laws and regulations are of great significance to regulating the industry.

6 Hedge fund EDL bets the euro will fall to 0.8

In recent days, hedge fund EDL Capital is betting the euro will fall to 0.8, a level not seen in more than 20 years. The founder of EDL Capital believes that the current strength of the dollar, which is weighing on the euro, may turn around and open the curtain of a "bear market in the euro."

Commentary: The euro is facing a test.

Part of the picture comes from the Internet, and the infringement contact is deleted