Time: 2022-08-09 Preview:

1 Ten billion quantitative private placements increased to 30

According to data from third-party institutions, after Zhuhai Investment, Zhuhai Zhicheng Zhuoyuan and Shanghai Kuande, two quantitative private equity firms, successfully reached the tens of billions mark. At present, the number of tens of billions of quantitative private placements has increased to 30.

Brief Comment: The expansion of the tens of billions of quantitative private equity camps.

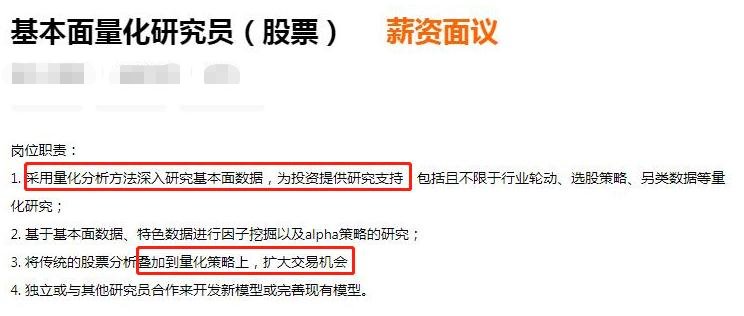

2 Quantitative institutions use multiple strategies to expand revenue sources

According to industry insiders, with the rapid development of quantitative transactions, more and more tens of billions of quantitative private equity options have been reduced in frequency. At the same time, more and more quantitative private placements are recruiting fundamental researchers, hoping to expand revenue sources and push multi-strategy products.

Commentary: The silent contest between institutions has begun.

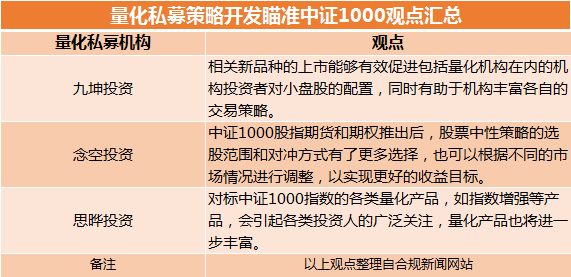

3 Quantitative private equity strategy development aims at CSI 1000

Recently, many top quantitative private equity investors said in an interview with reporters that CSI 1000-related derivatives have become an important force for private equity to develop and upgrade strategies.

Comments: New private equity products are worth looking forward to.

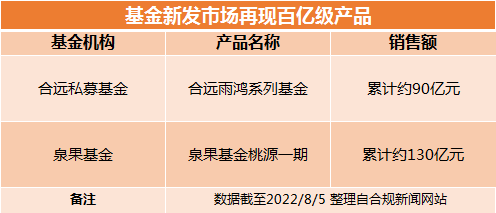

4 The new fund market reproduces tens of billions of popular products

Recently, the new fund market has reappeared tens of billions of popular products, which has attracted market attention. According to market analysts, the market has recovered, managers have past performance, reputation, and investors' willingness to deploy, etc., are the reasons for the explosion. In addition, many private equity firms are currently optimistic about investment opportunities at the bottom of the market, and are deploying equity products against the trend.

Commentary: Popular products are not accidental.

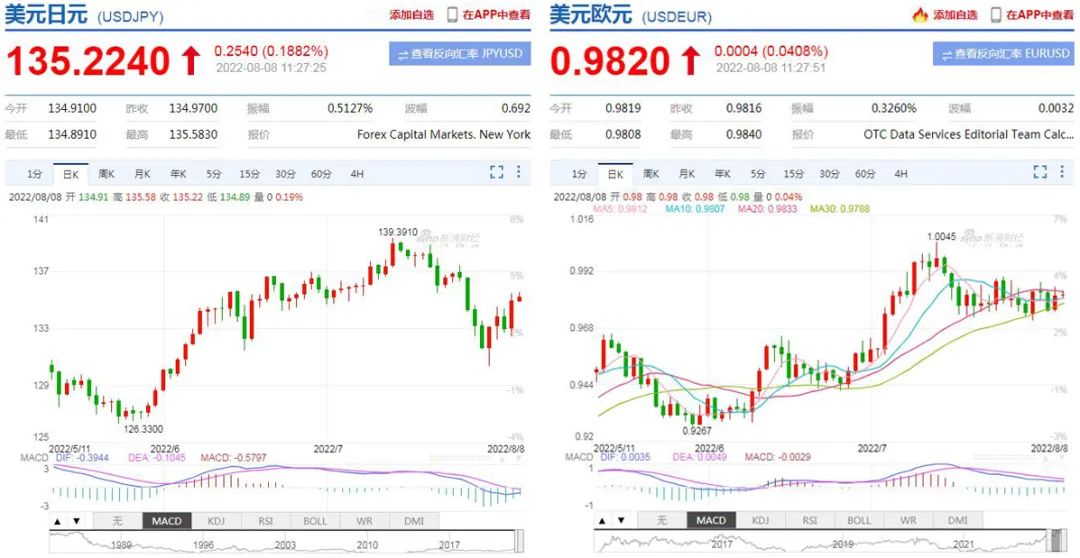

5 Forex hedge funds usher in spring

Foreign exchange hedge funds tracked by Eurekahedge Pte Ltd. are on track for their best year since 2003 as volatility rises and the monetary policies of major central banks around the world diverge. The trend-following money manager in the Barclays Hedged Index is also set for its strongest performance since 2003 as the dollar continues to rise, sending the euro and yen tumbling.

Commentary: Foreign exchange hedge funds are recovering.

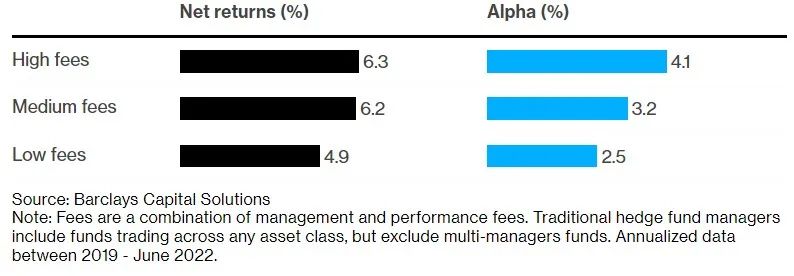

6 Hedge funds tend to perform better with higher fees

Recently, Barclays' Capital Solutions division conducted a statistical analysis of the fees and returns of 290 hedge funds, and found that the hedge fund companies with the highest fees tended to return more than their lower-fee competitors in the long run.

Comments: Buying funds may also talk about "ostentation".

Part of the picture comes from the Internet, and the infringement contact is deleted