Time: 2022-08-16 Preview:

From January to July, a total of 29 10 billion private placements have turned red, and there are 3 10 billion private placements with an increase of more than 10%, all of which are stock strategy private placements. In addition, Xie Investment, Shanghai Kuande, Egret Asset Management and other tens of billions of quantitative private equity have also achieved good performance this year.

Commentary: The performance of tens of billions of private equity has rebounded significantly.

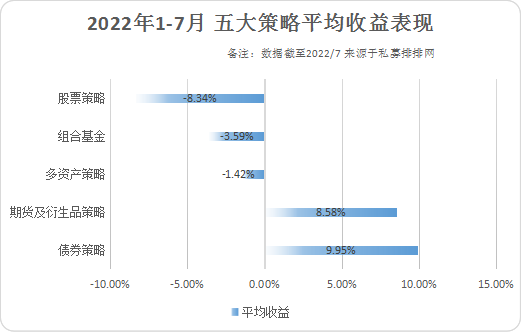

According to the latest data, in the first seven months of this year, bond strategies and CTA strategies in private placement strategies performed relatively well, while stock strategies were relatively affected by market fluctuations and performed weaker than other strategies.

Commentary: Bond and CTA strategies are relatively defensive

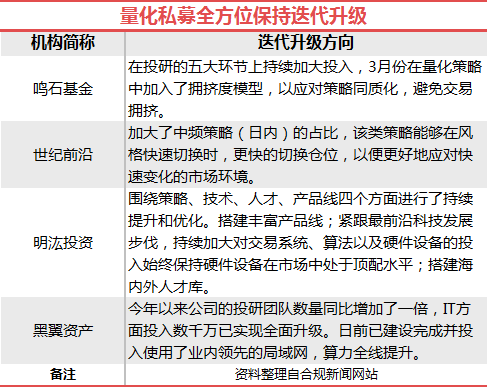

Data show that since May, the excess returns of quantitative strategies have rebounded significantly. In the face of market fluctuations and industry changes, quantitative institutions are constantly iterating and innovating, "grabbing" hard and soft power, and continuously upgrading in terms of strategy, technology, and personnel teams.

Commentary: Iterative innovation is the key to enhancing competitiveness

Recently, there are rumors that Magic Square Quantitatively persuaded investors to redeem all CSI 1000 Index Enhanced Products. The relevant executives of Magic Square Quantitative said that the rumor is a rumor, and there is currently no “dissuade” investors from the CSI 1000 index products at the company level.

Commentary: Rumors are scary, stay rational.

Recently, Bridgewater has registered the Chinese and English trademarks of "All Weather" in China. If other organizations sell products with the "All Weather" trademark in the future, they will infringe. Up to now, there are 584 private equity products in China named "All Weather".

Commentary: Bridgewater is fully committed to maintaining "all-weather" IP.

The U.S. Securities and Exchange Commission (SEC) recently proposed a regulatory proposal that would require hedge funds to disclose more information about their formation and investment strategies to the regulator — the most intense U.S. regulation in a decade.

Commentary: U.S. Hedge Fund Supervision Strengthens.

Some pictures are from the Internet, and the infringement contact will be deleted