More

From January to May, the list of private equity companies with positive income of 10 billion yuan was released. After the rebound in May, the number of private equity companies with positive income of 10 billion yuan during the year increased to 12, and Vena Investment ranked first on the list. Among them, the tens of billions of private placements with positive returns are mainly managed futures private placements and bond strategic private placements. Comments: Managed futures strategies and bond strategies performed well. Private equity nuggets have digital transformation investment opportunities. Affected by the epidemic, the digital transformation of physical enterprises has been further accelerated. Many securities private placements regard digital transformation as a key investment theme, and conduct forward-looking research and opportunistic layouts from a fundamental perspective. Brief Comment: Focus on the digital transformation of enterprises. 3 June private placement

2022-06-21

At the time of the global economic crisis in 2008, top venture capital firm Sequoia convened its portfolio companies to analyze and warn investors of the bad economic environment, sharing a PPT report R.I.P. Good Times. After 14 years, in May of this year, Sequoia Capital issued the latest warning to its portfolio companies, sharing a 52-page PPT report Adapting to Endure. The report went viral on the Internet and attracted much attention, and people were concerned about whether a new economic winter had come.

2022-06-21

The latest ranking of tens of billions of private equity index products has been released. According to the latest data from the agency, from the perspective of excess returns, the performance of private equity index products this year is still remarkable. Among them, the performance of tens of billions of private equity is better than the city's overall. Comments: Private placement refers to increasing the value of product allocation still worthy of attention. During the year, the tens of billions of private equity camps were reshuffled. As of now, there are 109 domestic private equity companies of tens of billions of dollars. Industry insiders predict that factors such as market cyclical changes, their own strategic adaptability, and the stability of the core team will continue to have a profound impact on the competitive landscape of leading institutions in the private equity industry. Brief comment: Changes in the head private equity should be viewed objectively and rationally. 3 May Fund Company

2022-06-07

The performance of quantitative index increase strategy products has rebounded significantly. Since May, private equity quantitative index increase products have performed relatively well. According to industry analysis, this is due to the double rebound of Beta and Alpha, the improvement of liquidity, the return of style, and the decline of crowding, etc. However, the short-term excess has a great relationship with the market and is random. It is recommended that investors pay more attention to the long-term excess. Brief comment: Quantitative industries and products need to be viewed from a long-term and developmental perspective. The annual income ranking of 10 billion quantitative private equity has been released. The latest data shows that the average income of the quantitative products included in the statistics of Luoshu Investment, Si Xie Investment, and Black Wing Assets has ranked in the top three respectively this year. These three billion

2022-05-31

On April 29th, the "2021 China Quantitative Investment White Paper" jointly organized by Huatai Securities, Kuanbang Technology, Amazon Cloud Technology, Chaoyang Sustainability, Financial Level and other market authorities was officially released, and a press conference was held in Shenzhen. . Wang Hengpeng, a partner of Jukuan Investment, attended the meeting and gave a speech entitled "Practical Exploration of Quantitative Team Collaboration". We recorded the text for readers. The "2021 China Quantitative Investment White Paper" (hereinafter referred to as the "White Paper") said: China's quantitative investment is 35 years behind the United States. But in fact, in the past four or five years,

2022-05-31

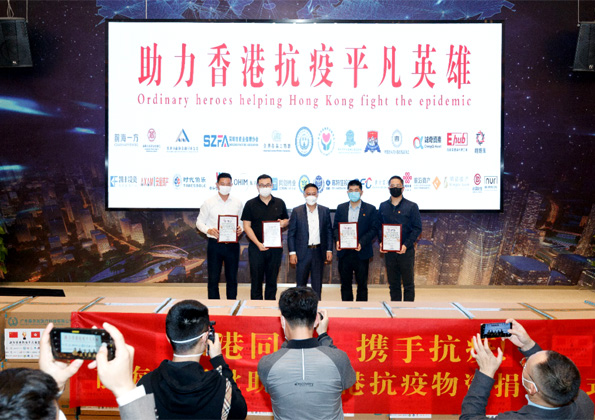

A number of private equity firms indicated that they would increase their positions at an opportune time. Recently, the A-share market has stabilized at a low level, and the profit-making effect of individual stocks has improved significantly, and the overall trend is positive. In terms of position management, a number of first-tier private equity firms said that at this stage, they would “not hesitate” to continue to increase positions. Comment: Investment confidence continues to pick up. Shenzhen Private Equity Association has played a significant role in fighting the epidemic. Since the beginning of the epidemic in Shenzhen, Shenzhen Private Equity Association has led the fight against the epidemic with party building, and has effectively shouldered the political responsibility of epidemic prevention and control; upload and release, build a bridge between supervision and the market; Support Hong Kong and serve the overall situation of "One Country, Two Systems"; make the best use of the situation and keep working online. Commentary: The association is solidly responsible for the fight against the epidemic

2022-05-24